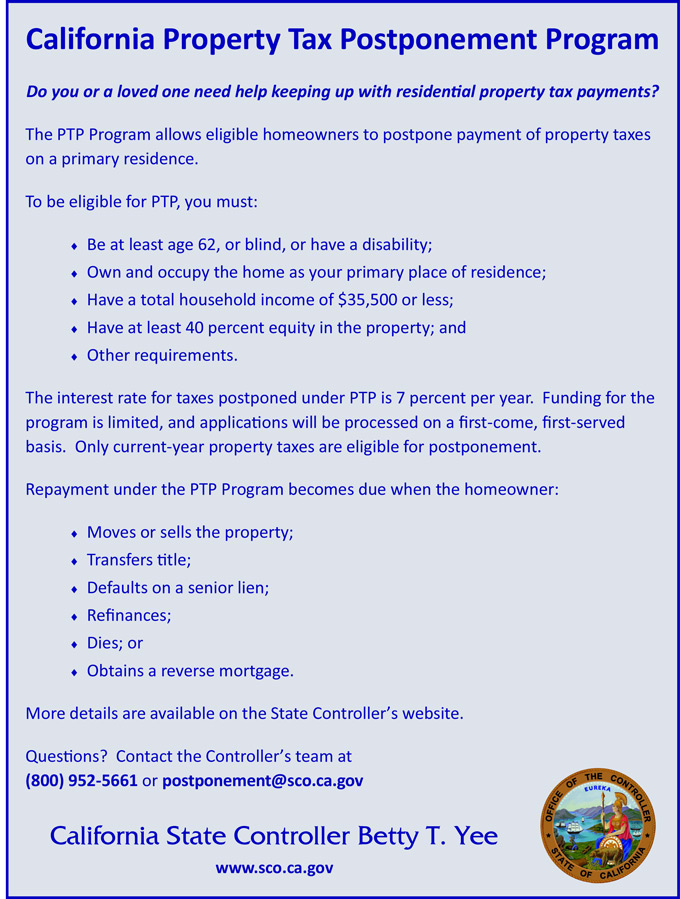

The program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including 40 percent equity in the home and an annual household income of $35,500 or less.

The 2016 application filing period is closed.

Applications for 2017-18 will be available in September 2017.

Please call (800) 952-5661 or email postponement@sco.ca.gov to join our mailing list.

Fact Sheet

The State Controller’s Office (SCO) administers the Property Tax Postponement (PTP) Program, which allows eligible homeowners to postpone payment of current year property taxes on their primary residence. A postponement of property taxes is a deferment of current year property taxes that must eventually be repaid. Repayment is secured by a lien against the property.

Funding is limited and distributed on a first come, first served basis. Due to funding limitations, all who qualify may not be approved.

Eligibility requirements

To qualify, a homeowner must apply and meet all of the following criteria for every year in which a postponement of property taxes is desired:

- Be at least 62 years of age, or blind, or disabled;

- Own and occupy the real property as his or her principal place of residence (mobile, manufactured, or modular homes, whether affixed or unaffixed, floating homes, and house boats are not eligible);

- Have a total household income of $35,500 or less;

- Have at least 40 percent equity in the property; and

- Not have a reverse mortgage on the property.

Delinquent and/or defaulted taxes

State law does not allow SCO to pay for delinquent and/or defaulted property taxes that are owed on the property that is being considered for postponement. These taxes are your responsibility to pay. However, you may still qualify for postponement of current-year taxes. The amount of defaulted property taxes will be added to the amounts owed against the property to determine equity.

Interest rate on postponed property taxes

The interest rate for all taxes postponed under the PTP program is 7 percent per year. Interest on postponed property taxes is computed monthly on a simple interest basis. Interest on the postponement account continues to accrue until all postponed property taxes plus interest are repaid to the state.

Example: on a PTP postponement of $1,000 in taxes, the interest would be $70 per year, or $5.83 each month.

Notice of lien for postponed property taxes

To secure repayment of the postponed property taxes, SCO records a lien against the property. The lien remains in effect until the account is paid in full.

Property taxes paid by a lender/mortgage company

SCO is not responsible for contacting your lender if your property taxes are currently paid through an impound, escrow, or other type of account. If you are approved for PTP, SCO will make a payment on your behalf directly to the county tax collector. Property owners are responsible for contacting their lenders and paying all amounts due.

Collection and repayment process

The homeowner may pay all or part of the balance to SCO at any time. However, postponed property taxes and interest become immediately due and payable when the homeowner does any of the following:

- Moves from the property;

- Sells or conveys title to the property;

- Dies and does not have a spouse, registered domestic partner, or other qualified individual who continues to reside in the property;

- Allows future property taxes or other senior liens to become delinquent; or

- Refinances or obtains a reverse mortgage for the property.

Payments

You may make full or partial payments on your account at any time. All payments received are applied first toward accumulated interest and then toward the outstanding principal balance (postponed tax amount). Make your check or money order payable to the California State Controller’s Office and mail it to:

California State Controller’s Office

Departmental Accounting Office – PTP

P.O. Box 942850

Sacramento, CA 94250-0001

To ensure proper credit, please include your SCO account number or property address on the check or money order, and on any accompanying documents.

Account statement

SCO provides you with an account statement each year. However, you may obtain an account statement at any time by contacting SCO.

Contact information

Questions? Contact the Controller’s team at (800) 952-5661 or postponement@sco.ca.gov.

For more information: Frequently Asked Questions

Source: CA. SCO