Housing affordability falls to 10-year lows, extending into traditionally more affordable regions

- Twenty-six percent of California households could afford to purchase the $596,730 median-priced home in the second quarter of 2018, down from 31 percent in first-quarter 2018 and down from 29 percent a year ago.

- A minimum annual income of $126,490 was needed to make monthly payments of $3,160, including principal, interest, and taxes on a 30-year fixed-rate mortgage at a 4.70 percent interest rate.

- Thirty-six percent of home buyers were able to purchase the $477,790 median-priced condo or townhome. An annual income of $101,270 was required to make a monthly payment of $2,530.

August 13, 2018 - LOS ANGELES – Record home price increases and higher interest rates combined to constrain California housing affordability to the lowest levels in 10 years, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said last week.

The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in second-quarter 2018 fell to 26 percent from 31 percent in the first quarter of 2018 and was down from 29 percent in the second quarter a year ago, according to C.A.R.’s Traditional Housing Affordability Index (HAI). This is the 21st consecutive quarter that the index has been below 40 percent. California’s housing affordability index hit a peak of 56 percent in the second quarter of 2012.

C.A.R.’s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for home buyers in the state.

A minimum annual income of $126,490 was needed to qualify for the purchase of a $596,730 statewide median-priced, existing single-family home in the second quarter of 2018. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $3,160, assuming a 20 percent down payment and an effective composite interest rate of 4.70 percent. The effective composite interest rate in first-quarter 2018 was 4.44 percent and 4.09 percent in the second quarter of 2017.

While low housing affordability may be typical in many Bay Area counties, more traditionally affordable areas were at 10-year lows in the second quarter. Those that reached the decade-low include Alameda, Merced, Orange, Riverside, Sacramento, San Bernardino, San Diego, San Mateo, Santa Clara, Santa Cruz, and Sonoma.

Housing affordability for condominiums and townhomes also fell in second-quarter 2018 compared to the previous quarter with 36 percent of California households earning the minimum income to qualify for the purchase of a $477,790 median-priced condominium/townhome, down from 39 percent in the first quarter. An annual income of $101,270 was required to make monthly payments of $2,530.

Key points from the second-quarter 2018 Housing Affordability report include:

- Housing affordability improved from second-quarter 2017 in 8 tracked counties and declined in 37 counties. Affordability in four counties remained flat.

- In the San Francisco Bay Area, affordability improved from a year ago in San Francisco and Marin counties, primarily due to higher wages. Affordability fell in five counties (Alameda, Contra Costa, Santa Clara, Solano, and Sonoma). Affordability held steady in Napa and San Mateo counties.

- In Southern California, affordability improved only in Ventura, and dropped in five counties (Los Angeles, Orange, Riverside, San Bernardino, and San Diego) compared to a year ago.

- In the Central Valley, only Madera County saw an improvement in affordability from second-quarter 2017. Housing affordability decreased from a year ago in nine counties (Kern, Kings, Merced, Placer, Sacramento, San Benito, San Joaquin, Stanislaus and Tulare). Affordability held steady only in Fresno County.

- In the Central Coast region, only Santa Barbara experienced a year-to-year improvement in affordability, while three counties (Monterey, San Luis Obispo, and Santa Cruz) posted a decline.

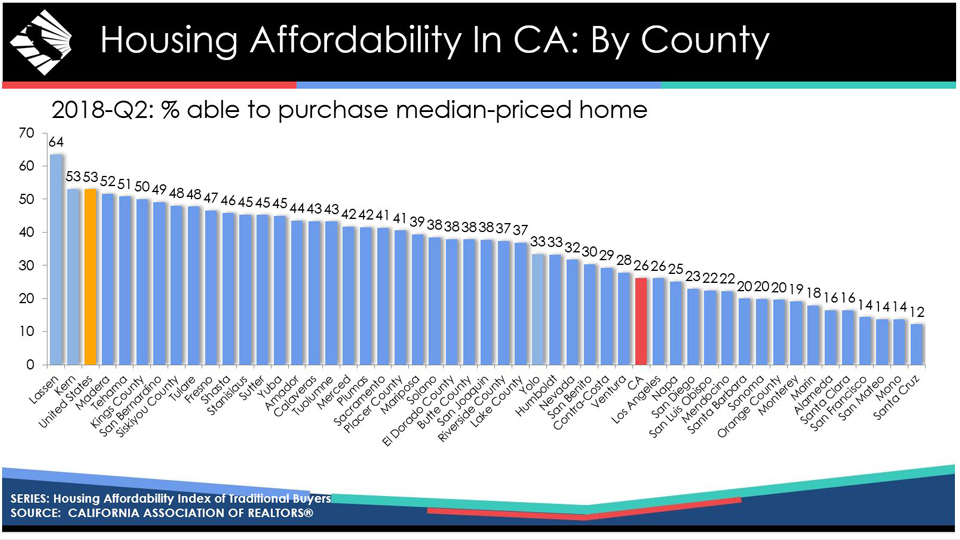

- During the second quarter of 2018, the most affordable counties in California were Lassen (64 percent), Kern (53 percent), Madera (52 percent), Tehama (51 percent) andKings (50 percent).

- Santa Cruz (12 percent), San Francisco, San Mateo, and Mono (all at 14 percent), and Alameda and Santa Clara (both at 16 percent) counties were the least affordable areas in the state.

Housing Affordability slides (click link to open)

Affordability peak versus current

Annual required income peak vs. current

Monthly PITI peak versus current

Affordability by region peak versus current

Housing affordability by county

See C.A.R.’s historical housing affordability data.

See first-time buyer housing affordability data.

Leading the way…® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than190,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

CALIFORNIA ASSOCIATION OF REALTORS®

Traditional Housing Affordability Index

Second quarter 2018

|

STATE/REGION/COUNTY |

2nd Qtr. 2018 |

Median Home Price |

Monthly Payment Including Taxes & Insurance |

Minimum Qualifying Income |

|

Calif. Single-family Home |

26 |

$596,730 |

$3,160 |

$126,490 |

|

Calif. Condo/Townhome |

36 |

$477,790 |

$2,530 |

$101,270 |

|

Los Angeles Metro Area |

29 |

$530,000 |

$2,810 |

$112,340 |

|

Inland Empire |

41 |

$360,000 |

$1,910 |

$76,310 |

|

San Francisco Bay Area |

18 |

$1,035,000 |

$5,480 |

$219,380 |

|

United States |

53 |

$269,000 |

$1,430 |

$57,020 |

|

San Francisco Bay Area |

||||

|

Alameda |

16 |

$1,000,000 |

$5,300 |

$211,960 |

|

Contra Costa |

29 |

$695,000 |

$3,680 |

$147,320 |

|

Marin |

18 |

$1,400,000 |

$7,420 |

$296,750 |

|

Napa |

25 |

$707,250 |

$3,750 |

$149,910 |

|

San Francisco |

14 |

$1,625,000 |

$8,610 |

$344,440 |

|

San Mateo |

14 |

$1,650,000 |

$8,740 |

$349,740 |

|

Santa Clara |

16 |

$1,405,000 |

$7,450 |

$297,810 |

|

Solano |

38 |

$450,000 |

$2,380 |

$95,380 |

|

Sonoma |

20 |

$695,000 |

$3,680 |

$147,320 |

|

Southern California |

||||

|

Los Angeles |

26 |

$557,220 |

$2,950 |

$118,110 |

|

Orange |

20 |

$830,000 |

$4,400 |

$175,930 |

|

Riverside |

37 |

$405,000 |

$2,150 |

$85,850 |

|

San Bernardino |

49 |

$290,000 |

$1,540 |

$61,470 |

|

San Diego |

23 |

$645,000 |

$3,420 |

$136,720 |

|

Ventura |

28 |

$670,000 |

$3,550 |

$142,020 |

|

Central Coast |

||||

|

Monterey |

19 |

$647,000 |

$3,430 |

$137,140 |

|

San Luis Obispo |

22 |

$618,500 |

$3,280 |

$131,100 |

|

Santa Barbara |

20 |

$695,000 |

$3,680 |

$147,320 |

|

Santa Cruz |

12 |

$905,000 |

$4,800 |

$191,830 |

|

Central Valley |

||||

|

Fresno |

47 |

$268,390 |

$1,420 |

$56,890 |

|

Kern |

53 |

$244,000 |

$1,290 |

$51,720 |

|

Kings |

50 |

$235,000 |

$1,250 |

$49,810 |

|

Madera |

52 |

$238,000 |

$1,260 |

$50,450 |

|

Merced |

42 |

$265,000 |

$1,400 |

$56,170 |

|

Placer |

41 |

$495,900 |

$2,630 |

$105,110 |

|

Sacramento |

41 |

$374,000 |

$1,980 |

$79,270 |

|

San Benito |

30 |

$571,000 |

$3,030 |

$121,030 |

|

San Joaquin |

38 |

$373,380 |

$1,980 |

$79,140 |

|

Stanislaus |

45 |

$315,000 |

$1,670 |

$66,770 |

|

Tulare |

48 |

$233,000 |

$1,230 |

$49,390 |

|

Other Calif. Counties |

||||

|

Amador |

44 |

$335,000 |

$1,780 |

$71,010 |

|

Butte |

38 |

$320,000 |

$1,700 |

$67,830 |

|

Calaveras |

43 |

$329,000 |

$1,740 |

$69,740 |

|

El Dorado |

38 |

$525,000 |

$2,780 |

$111,280 |

|

Humboldt |

33 |

$315,000 |

$1,670 |

$66,770 |

|

Lake County |

37 |

$283,000 |

$1,500 |

$59,990 |

|

Lassen |

64 |

$192,500 |

$1,020 |

$40,800 |

|

Mariposa |

39 |

$320,000 |

$1,700 |

$67,830 |

|

Mendocino |

22 |

$430,000 |

$2,280 |

$91,140 |

|

Mono |

14 |

$624,500 |

$3,310 |

$132,370 |

|

Nevada |

32 |

$435,000 |

$2,310 |

$92,200 |

|

Plumas |

42 |

$297,000 |

$1,570 |

$62,950 |

|

Shasta |

46 |

$265,500 |

$1,410 |

$56,280 |

|

Siskiyou |

48 |

$207,500 |

$1,100 |

$43,980 |

|

Sutter |

45 |

$299,950 |

$1,590 |

$63,580 |

|

Tehama |

51 |

$215,900 |

$1,140 |

$45,760 |

|

Tuolumne |

43 |

$308,500 |

$1,630 |

$65,390 |

|

Yolo |

33 |

$469,500 |

$2,490 |

$99,520 |

|

Yuba |

45 |

$290,000 |

$1,540 |

$61,470 |

CALIFORNIA ASSOCIATION OF REALTORS®

Traditional Housing Affordability Index

Second quarter 2018

|

STATE/REGION/COUNTY |

2nd Qtr. 2018 |

1st Qtr. 2018 |

2nd Qtr. 2017 |

||

|

Calif. Single-family home |

26 |

31 |

29 |

||

|

Calif. Condo/Townhome |

36 |

39 |

38 |

||

|

Los Angeles Metro Area |

29 |

32 |

31 |

||

|

Inland Empire |

41 |

43 |

43 |

||

|

San Francisco Bay Area |

18 |

23 |

21 |

||

|

United States |

53 |

57 |

55 |

||

|

San Francisco Bay Area |

|||||

|

Alameda |

16 |

22 |

19 |

||

|

Contra Costa |

29 |

36 |

31 |

||

|

Marin |

18 |

18 |

17 |

||

|

Napa |

25 |

28 |

25 |

||

|

San Francisco |

14 |

15 |

12 |

||

|

San Mateo |

14 |

15 |

14 |

||

|

Santa Clara |

16 |

17 |

17 |

||

|

Solano |

38 |

42 |

44 |

||

|

Sonoma |

20 |

21 |

25 |

||

|

Southern California |

|||||

|

Los Angeles |

26 |

28 |

28 |

||

|

Orange |

20 |

21 |

21 |

||

|

Riverside |

37 |

39 |

39 |

||

|

San Bernardino |

49 |

52 |

51 |

||

|

San Diego |

23 |

26 |

26 |

||

|

Ventura |

28 |

31 |

27 |

||

|

Central Coast |

|||||

|

Monterey |

19 |

23 |

21 |

||

|

San Luis Obispo |

22 |

25 |

26 |

||

|

Santa Barbara |

20 |

22 |

16 |

||

|

Santa Cruz |

12 |

15 |

17 |

||

|

Central Valley |

|||||

|

Fresno |

47 |

49 |

47 |

||

|

Kern |

53 |

56 |

54 |

||

|

Kings |

50 |

52 |

52 |

||

|

Madera |

52 |

50 |

44 |

||

|

Merced |

42 |

43 |

48 |

||

|

Placer |

41 |

44 |

43 |

||

|

Sacramento |

41 |

44 |

45 |

||

|

San Benito |

30 |

32 |

33 |

||

|

San Joaquin |

38 |

40 |

43 |

||

|

Stanislaus |

45 |

48 |

47 |

||

|

Tulare |

48 |

50 |

52 |

||

|

Other Calif. Counties |

|||||

|

Amador |

44 |

45 |

42 |

||

|

Butte |

38 |

41 |

39 |

||

|

Calaveras |

43 |

46 |

49 |

||

|

El Dorado |

38 |

42 |

40 |

||

|

Humboldt |

33 |

36 |

36 |

||

|

Lake County |

37 |

40 |

38 |

||

|

Lassen |

64 |

68 |

64 |

||

|

Mariposa |

39 |

44 |

50 |

r |

|

|

Mendocino |

22 |

25 |

27 |

||

|

Mono |

14 |

8 |

25 |

||

|

Nevada |

32 |

37 |

39 |

||

|

Plumas |

42 |

47 |

47 |

||

|

Shasta |

46 |

49 |

47 |

||

|

Siskiyou |

48 |

48 |

47 |

||

|

Sutter |

45 |

49 |

53 |

||

|

Tehama |

51 |

51 |

57 |

||

|

Tuolumne |

43 |

49 |

46 |

||

|

Yolo |

33 |

41 |

35 |

||

|

Yuba |

45 |

49 |

43 |

r = revised

Source: C.A.R.