March existing home sales and median price accelerate from previous month and year

- Existing, single-family home sales totaled 415,220 in March on a seasonally adjusted annualized rate, up 5.5 percent from February and 5.7 percent above March 2015.

- March’s statewide median home price was $483,280, up 8.9 percent from February and up 4 percent from March 2015.

- The median number of days it took to sell a single-family home declined in March to 29.9 days, compared with 41.4 days in February and 34.2 days in March 2015.

LOS ANGELES (April 18, 2016) – California home sales rose from both the previous month and year to post the highest sales pace in six months, while strained housing supplies continued to push home prices higher, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 415,220 units in March, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide sales figure represents what would be the total number of homes sold during 2016 if sales maintained the March pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

The March figure was up 5.5 percent from the revised 393,430 level in February and up 5.7 percent compared with home sales in March 2015 of a revised 392,660. March’s sales level rose above the 400,000 level for the first time in three months.

“California’s housing market is moving in the right direction as we enter the spring home-buying season, but sales growth will likely be isolated in areas where inventory is more abundant and housing affordability is less of an issue,” said C.A.R. President Pat “Ziggy” Zicarelli. “For example, in the Bay Area, where inventory is extremely tight, annual sales are down in the double-digits in seven of the region’s nine counties. Solano and Sonoma, two counties where homes are relatively more affordable, were the exceptions. Home sales in these two counties grew from last year by nearly 11 percent and 5 percent, respectively.”

The median price of an existing, single-family detached California home rose 8.9 percent in March, reversing a two-month decline, to $483,280 from $443,950 in February. March’s median price was 4 percent higher than the revised $464,640 recorded in March 2015. The median sales price is the point at which half of homes sold for more and half sold for less; it is influenced by the types of homes selling as well as a general change in values.

“The economic fundamentals continue to support overall home sales growth, but a lack of housing inventory also will fuel more market competition as housing demand remains on an upward trend,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “Thin housing supplies appear to be the driving force behind the increase in sales-to-list price ratios, with the ratio rising in 28 of 40 reporting counties. On average, homes in the Bay Area and Sacramento sold for more than the list price, while homes in Southern California and the Central Valley sold below list price.”

Other key points from C.A.R.’s March 2016 resale housing report include:

• The number of active listings increased slightly for the third consecutive month after declining for five straight months, but was not enough to boost housing supplies. Active listings increased 3.9 percent from February on a statewide basis.

• The increase in active listings was outpaced by the rate of home sales, causing C.A.R.’s Unsold Inventory Index to drop from 4.6 months in February to 3.6 months in March. The index stood at 3.8 months in March 2015. The index indicates the number of months needed to sell the supply of homes on the market at the current sales rate. A six- to seven-month supply is considered typical in a normal market.

• The median number of days it took to sell a single-family home declined in March to 29.9 days, compared with 41.4 days in February and 34.2 days in March 2015.

• According to C.A.R.’s sales-to-list price ratio*, tight inventories also appear to be driving closed prices closer to listing prices as sales-to-list price ratio increased in 28 of 40 counties for which data is available. Sales prices rose to 98.8 percent of listing prices statewide in March from 98.2 percent in February.

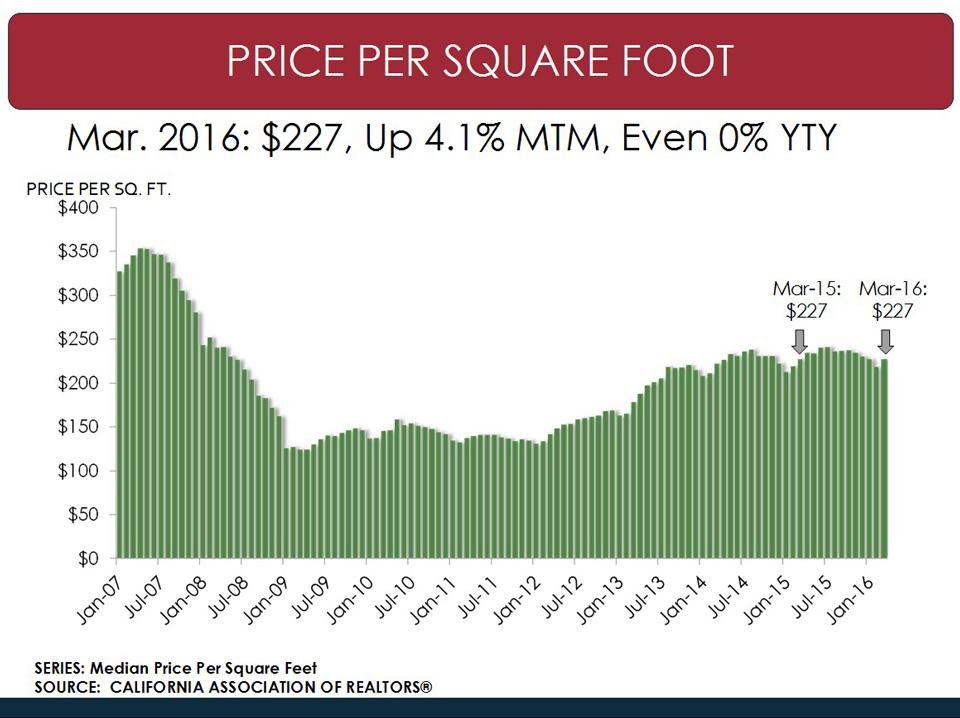

• The average price per square foot** for an existing, single-family home statewide was $227 in March 2016, up from $218 in February and unchanged from $227 in March 2015.

• San Francisco continued to have the highest price per square foot in March at $879/sq. ft., followed by San Mateo ($763/sq. ft.), and Santa Clara ($625/sq. ft.). The three counties with the lowest price per square foot in March were Siskiyou ($102/sq. ft.), Madera ($119/sq. ft.), and Kings ($123/sq. ft.).

• Mortgage rates were essentially flat in March, with the 30-year, fixed-mortgage interest rate averaging 3.69 percent, compared with 3.66 percent in February and 3.77 percent in March 2015, according to Freddie Mac. Adjustable-mortgage interest rates, however, edged up, averaging 2.90 percent in March, up from 2.83 percent in February and 2.74 percent in March 2015.

Graphics (click links to open):

• March sales at-a-glance infographic.

• Calif. existing home sales historical.

• Share of sales by price range.

• Sales to active listings ratio by region.

• CA sales to list price ratio.

• CA price per square foot.

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state, and represent statistics of existing single-family detached homes only. County sales data are not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower-end or the upper-end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 38 counties.

Leading the way…® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with 185,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

March 2016 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

| March-16 | Median Sold Price of Existing Single-Family Homes | Sales | |||||||

| State/Region/County | Mar-16 | Feb-16 | Mar-15 | MTM% Chg | YTY% Chg | MTM% Chg | YTY% Chg | ||

| CA SFH (SAAR) | $483,280 | $443,950 | r | $464,640 | r | 8.9% | 4.0% | 5.5% | 5.7% |

| CA Condo/Townhomes | $399,060 | $387,370 | r | $381,250 | r | 3.0% | 4.7% | 40.5% | 1.1% |

| Los Angeles Metro Area | $446,240 | $428,090 | $427,990 | r | 4.2% | 4.3% | 39.5% | 1.7% | |

| Inland Empire | $309,890 | $290,270 | $290,240 | 6.8% | 6.8% | 38.6% | 5.3% | ||

| S.F. Bay Area | $761,160 | $696,430 | $730,650 | 9.3% | 4.2% | 47.1% | -8.1% | ||

| S.F. Bay Area | |||||||||

| Alameda | $762,570 | $712,990 | $713,060 | r | 7.0% | 6.9% | 61.5% | -7.6% | |

| Contra-Costa | $572,620 | $538,650 | $491,780 | r | 6.3% | 16.4% | 47.5% | -7.9% | |

| Marin | $1,148,150 | $1,113,640 | $1,085,230 | 3.1% | 5.8% | 36.2% | -30.1% | ||

| Napa | $666,670 | $664,470 | $562,500 | 0.3% | 18.5% | 70.9% | -10.5% | ||

| San Francisco | $1,360,580 | $1,437,500 | $1,275,000 | -5.4% | 6.7% | 52.5% | -17.0% | ||

| San Mateo | $1,205,000 | $1,200,000 | $1,300,000 | 0.4% | -7.3% | 51.8% | -13.5% | ||

| Santa Clara | $1,065,000 | $942,500 | $932,100 | 13.0% | 14.3% | 51.8% | -12.4% | ||

| Solano | $376,420 | $365,620 | $345,100 | 3.0% | 9.1% | 20.0% | 10.8% | ||

| Sonoma | $596,090 | $554,610 | $519,500 | 7.5% | 14.7% | 39.5% | 5.0% | ||

| Southern California | |||||||||

| Los Angeles | $440,460 | $445,030 | $419,370 | r | -1.0% | 5.0% | 37.9% | -0.4% | |

| Orange | $721,140 | $712,560 | $696,060 | 1.2% | 3.6% | 38.5% | -3.5% | ||

| Riverside | $355,590 | $334,440 | $331,710 | 6.3% | 7.2% | 36.3% | 1.6% | ||

| San Bernardino | $237,350 | $226,870 | $215,640 | 4.6% | 10.1% | 42.5% | 12.2% | ||

| San Diego | $573,580 | $537,580 | $530,650 | 6.7% | 8.1% | 40.5% | 1.1% | ||

| Ventura | $620,020 | $610,820 | $596,890 | 1.5% | 3.9% | 61.3% | 8.0% | ||

| Central Coast | |||||||||

| Monterey | $490,000 | $497,980 | $510,000 | -1.6% | -3.9% | 6.5% | -12.9% | ||

| San Luis Obispo | $561,010 | $527,080 | $507,440 | 6.4% | 10.6% | 52.2% | -2.4% | ||

| Santa Barbara | $596,770 | $729,170 | r | $797,410 | r | -18.2% | -25.2% | 63.8% | -3.3% |

| Santa Cruz | $790,000 | $794,500 | $747,250 | -0.6% | 5.7% | 41.5% | -6.3% | ||

| Central Valley | |||||||||

| Fresno | $230,880 | $210,370 | $213,960 | 9.7% | 7.9% | 23.9% | 7.4% | ||

| Glenn | $193,330 | $200,000 | $190,000 | -3.3% | 1.8% | -33.3% | -14.3% | ||

| Kern (Bakersfield) | $221,540 | $221,670 | r | $208,550 | r | -0.1% | 6.2% | 24.6% | 6.4% |

| Kings | $204,810 | $202,500 | $190,000 | 1.1% | 7.8% | 35.7% | 50.8% | ||

| Madera | $215,000 | $215,380 | $198,750 | -0.2% | 8.2% | 17.4% | -1.8% | ||

| Merced | $189,500 | $197,780 | $190,000 | -4.2% | -0.3% | 70.8% | 30.9% | ||

| Placer | $407,760 | $418,130 | $383,330 | -2.5% | 6.4% | 42.2% | -11.0% | ||

| Sacramento | $309,860 | $297,980 | $282,080 | 4.0% | 9.8% | 32.4% | 3.5% | ||

| San Benito | $495,000 | $464,500 | $474,900 | 6.6% | 4.2% | 52.6% | 13.7% | ||

| San Joaquin | $297,370 | $292,960 | $272,500 | 1.5% | 9.1% | 40.8% | 6.6% | ||

| Stanislaus | $262,390 | $253,350 | $242,170 | 3.6% | 8.3% | 36.0% | 10.0% | ||

| Tulare | $197,220 | $189,200 | $182,630 | 4.2% | 8.0% | 20.0% | 7.4% | ||

| Other Counties in California | |||||||||

| Amador | $307,890 | $267,860 | $250,000 | 14.9% | 23.2% | 77.4% | 71.9% | ||

| Butte | $283,870 | $270,830 | $233,930 | 4.8% | 21.3% | 29.2% | 13.5% | ||

| Calaveras | $271,870 | $265,620 | $258,330 | 2.4% | 5.2% | 9.1% | 35.2% | ||

| Del Norte | $196,670 | $180,000 | $140,000 | r | 9.3% | 40.5% | -11.5% | 27.8% | |

| El Dorado | $432,140 | $424,320 | $393,400 | 1.8% | 9.8% | 54.3% | 15.0% | ||

| Humboldt | $282,290 | $269,440 | $253,120 | 4.8% | 11.5% | 19.3% | 1.9% | ||

| Lake | $242,310 | $193,330 | $225,000 | 25.3% | 7.7% | 53.6% | 62.3% | ||

| Mariposa | $225,000 | $275,000 | $275,000 | -18.2% | -18.2% | -33.3% | 100.0% | ||

| Mendocino | $365,380 | $371,430 | $297,500 | -1.6% | 22.8% | 41.7% | 4.1% | ||

| Nevada | $361,430 | $298,150 | $330,360 | r | 21.2% | 9.4% | 25.0% | 1.9% | |

| Plumas | $231,250 | $266,670 | $241,670 | r | -13.3% | -4.3% | 75.0% | 40.0% | |

| Shasta | $218,750 | $213,410 | $223,750 | 2.5% | -2.2% | 45.5% | 18.5% | ||

| Siskiyou | $153,330 | $175,000 | $176,670 | -12.4% | -13.2% | -23.1% | -18.9% | ||

| Sutter | $230,680 | $232,890 | $250,000 | -0.9% | -7.7% | 31.4% | 1.5% | ||

| Tehama | $193,330 | $175,000 | $163,330 | 10.5% | 18.4% | 81.8% | -2.4% | ||

| Tuolumne | $239,710 | $272,500 | $232,140 | -12.0% | 3.3% | 71.8% | 1.5% | ||

| Yolo | $374,000 | $387,930 | $334,720 | -3.6% | 11.7% | 59.6% | 28.5% | ||

| Yuba | $232,500 | $221,150 | $198,890 | 5.1% | 16.9% | 29.2% | 25.4% | ||

March 2016 County Unsold Inventory and Time on Market

(Regional and condo sales data not seasonally adjusted)

| March-16 | Unsold Inventory Index | Median Time on Market | |||||||

| State/Region/County | Mar-16 | Feb-16 | Mar-15 | Mar-16 | Feb-16 | Mar-15 | |||

| CA SFH (SAAR) | 3.6 | 4.6 | 3.8 | 29.9 | 41.4 | r | 34.2 | ||

| CA Condo/Townhomes | 2.9 | 3.9 | 3.1 | r | 27.3 | 32.4 | r | 31.9 | |

| Los Angeles Metro Area | 4.0 | 5.4 | 4.2 | r | 48.7 | 55.8 | 51.3 | ||

| Inland Empire | 4.5 | 6.1 | 4.9 | 54.4 | 59.8 | 59.1 | |||

| S.F. Bay Area | 2.6 | 3.2 | 2.1 | r | 21.2 | 25.5 | 21.6 | ||

| S.F. Bay Area | |||||||||

| Alameda | 2.2 | 3.0 | 2.1 | r | 18.0 | 20.3 | 18.6 | ||

| Contra-Costa | 2.4 | 3.0 | 1.3 | r | 18.9 | 23.6 | 20.5 | ||

| Marin | 3.8 | 3.8 | 2.6 | 25.1 | 58.2 | 27.0 | |||

| Napa | 4.6 | 6.5 | 4.1 | 48.8 | 65.8 | 49.9 | |||

| San Francisco | 2.7 | 3.3 | 1.6 | 20.4 | 22.4 | 20.7 | |||

| San Mateo | 2.2 | 2.7 | 1.6 | 18.6 | 19.7 | 17.9 | |||

| Santa Clara | 2.4 | 2.9 | 1.9 | 18.1 | 21.1 | 17.7 | |||

| Solano | 2.6 | 2.8 | 3.7 | 38.3 | 47.6 | 46.4 | |||

| Sonoma | 3.1 | 3.9 | 3.7 | 45.6 | 59.8 | 43.6 | |||

| Southern California | |||||||||

| Los Angeles | 3.6 | 4.9 | 3.8 | r | 43.2 | 49.5 | 45.0 | ||

| Orange | 3.9 | 4.9 | 3.7 | 49.0 | 59.0 | 51.3 | |||

| Riverside | 4.8 | 6.4 | 5.0 | 57.5 | 65.0 | 64.5 | |||

| San Bernardino | 4.0 | 5.5 | 4.8 | 48.7 | 54.0 | 52.3 | |||

| San Diego | 3.4 | 4.5 | 3.7 | 23.2 | 26.3 | 24.7 | |||

| Ventura | 4.0 | 5.9 | 4.5 | 53.8 | 66.8 | 55.1 | |||

| Central Coast | |||||||||

| Monterey | 4.4 | 4.3 | 3.6 | 29.7 | 38.0 | 36.7 | |||

| San Luis Obispo | 4.7 | 6.5 | 4.6 | 28.8 | 41.1 | 28.4 | |||

| Santa Barbara | 4.6 | 6.8 | r | 3.8 | 31.0 | 40.5 | r | 29.5 | |

| Santa Cruz | 3.1 | 3.7 | 3.3 | 21.1 | 37.2 | 22.6 | |||

| Central Valley | |||||||||

| Fresno | 4.2 | 5.1 | 4.6 | 27.8 | 33.2 | 33.1 | |||

| Glenn | 5.3 | 3.1 | 5.5 | 100.7 | 61.0 | 105.5 | |||

| Kern (Bakersfield) | |||||||||