May 7, 2024 - NEW YORK—The Federal Reserve Bank of New York on Monday released results from its 2024 SCE Housing Survey, which is part of the broader Survey of Consumer Expectations (SCE) and provides information on consumers’ housing-related experiences and expectations. The results show that the pace at which households expect home prices to rise in the next year has reaccelerated after falling last year, with average one-year ahead expectations now reaching their second highest reading in the survey’s history. In contrast, home price growth expectations for the next five years declined slightly. Expectations about the change in the cost of rent were considerably higher than home price expectations but followed a similar pattern, as rental price growth expectations increased for one-year-ahead and were essentially flat for five-years ahead.

Homeowners’ expectations about the likelihood of refinancing their mortgages over the next 12 months rebounded slightly after falling last year, but remain well below pre-pandemic levels. Renters’ views on the ease of obtaining a mortgage deteriorated substantially, with 74.2% stating that obtaining a mortgage is somewhat or very difficult. In fact, renters’ self-assessed probability of ever owning a home decreased to a new series low.

The New York Fed also issued an accompanying Liberty Street Economics blog post that estimates the extent to which mortgage rate lock-in is suppressing U.S. household’s moving plans.

Key findings from the 2024 Survey, which was fielded in February 2024, are:

Home Prices/Rents

- Average one-year-ahead home price growth expectations increased to 5.1% in February 2024 from 2.6% in February 2023. This level is slightly above the pre-pandemic mean of 4.2%, but below the 2022 series high of 7%. The increase is broad based across demographic groups, but particularly large for respondents residing in the South. Annualized home price growth expectations for the five-year horizon decreased by 0.1 percentage point to 2.7%.

- Rent price growth expectations for the next year increased by 1.5 percentage points to 9.7%, which is the second highest reading in the series since 2022 and reversed last year’s decline. Annualized expectations for the next five years were essentially flat, increasing very slightly to 5.1% from 5.0%.

Housing Outlook

- While attitudes toward housing as a financial investment remained strongly positive, they weakened slightly from the previous year, as 67.1% of all respondents characterized buying property in their zip code as a “very good” or “somewhat good” investment. This is slightly below the readings of the last three years, but still above the levels of optimism that prevailed in the pre-pandemic period. The share of respondents reporting that housing is a “bad” or “somewhat bad” investment increased to 9.1% from 7.9% a year ago.

- Average expectations of residential mobility, the percent chance of moving to a different primary residence, fell to new series lows at both the one-year (13.4%) and three-year (24.5%) horizons, continuing a declining mobility trend since 2014.

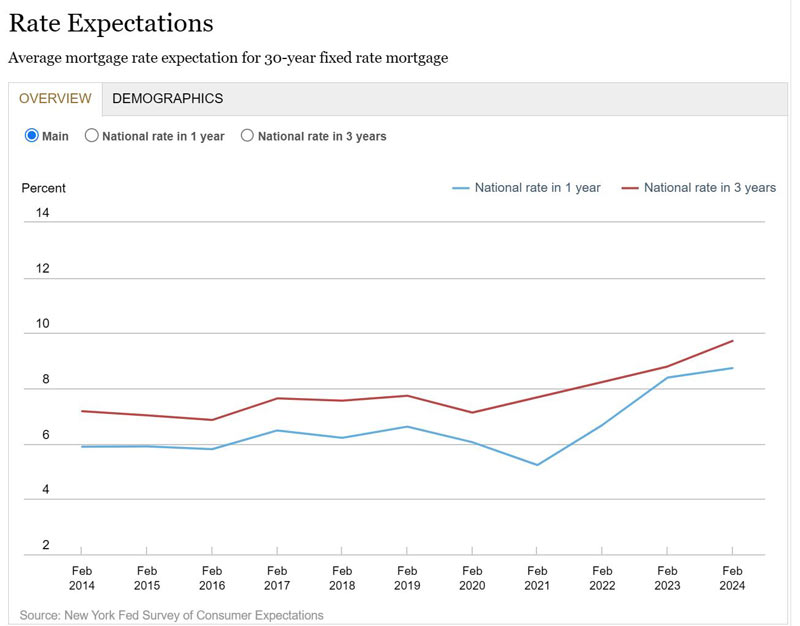

Mortgage Rates

- On average, households perceive that national mortgage rates are currently higher than pre-pandemic levels and expect them to rise further in the future. Households now expect mortgage rates to rise to 8.7% a year from now and 9.7% in three years’ time, both of which are series highs. Still, households on average believe there is a 61% chance that mortgage rates will fall over the next 12 months, which is also a series high.

Homeowners and Renters

- Homeowners’ expected probability of refinancing rebounded slightly to 6.3% after falling for the last two years. It remains well below the pre-pandemic average of 10.4%.

- Renters’ perceptions about the ease of obtaining a mortgage deteriorated substantially, as 74.2% stated that obtaining a mortgage is somewhat or very difficult. This represents an 8.4 percentage point increase from last year, and is well above the 2021 low of 50.5%. Further, renters’ self-assessed probability of ever owning a home decreased by 4.3 percentage points to 40.1%, which also reflects a series low.

About the SCE Housing Survey

The SCE Housing Survey, fielded annually as part of the Survey of Consumer Expectations (SCE) since 2014, provides rich and high-quality information on consumers’ experiences, behaviors, and expectations related to housing. The survey collects data on households' home price growth perceptions and expectations; intentions regarding moving and buying a home in the future; and perceptions of credit conditions, as well as climate risk. For homeowners, the survey collects detailed information on their mortgage debt, past actions and experiences such as foreclosure or refinancing, and expectations regarding future actions, such as taking out new debt or investing in the home. For renters, the survey elicits preferences for owning versus renting, and perceptions regarding the ease of obtaining mortgage credit, and expectations of evictions, among other things.

More information about the SCE survey goals, design, and content can be found here.

Source: Federal Reserve Bank of New York’s Center for Microeconomic Data