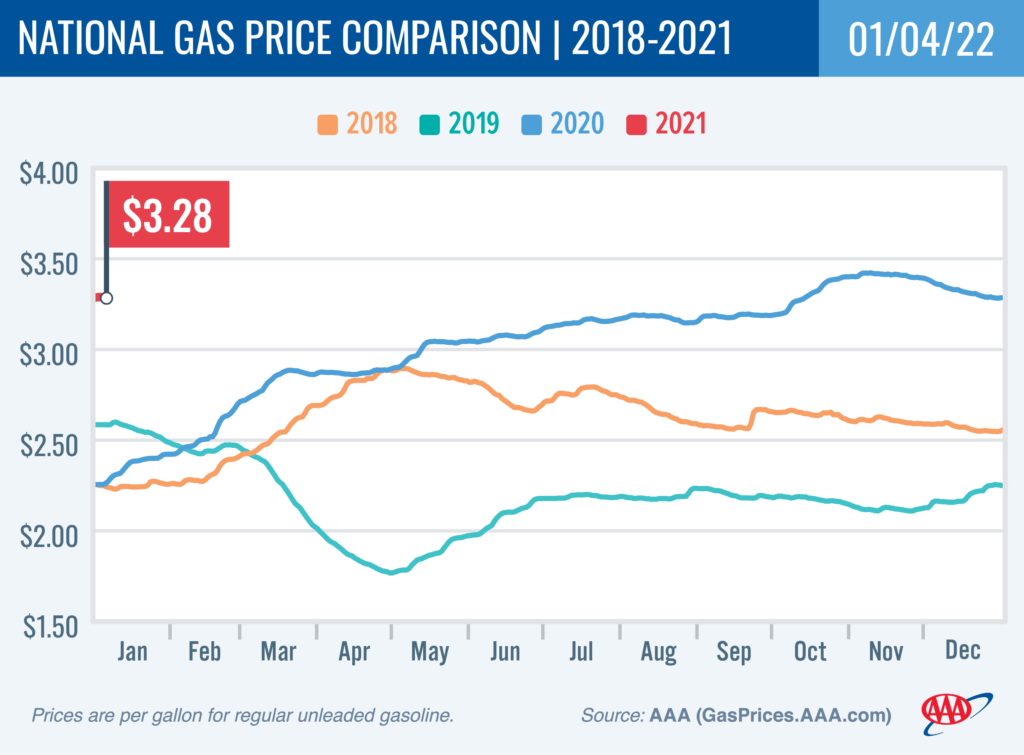

January 4, 2022 - WASHINGTON, D.C. - Gasoline prices barely budged over the past week, as fears of an omicron-driven economic “soft shutdown” dominate the news. Meanwhile, the pre-Christmas fire at the Exxon Mobil Corp plant in Baytown, Texas, is causing reduced output. Recent reporting, however, indicates the damage was to a non-refining section of the complex. The plant is the nation’s fourth-biggest oil refinery, with the capacity to process 560,500 barrels per day of crude. The national average for a gallon of gas remained at $3.28 on the week.

“There is a lot of uncertainty about the potential economic impact of the COVID-19 omicron variant. Will it peak quickly and vanish as some hope, or will it linger as others fear?” said Andrew Gross, AAA spokesperson. “And we are seeing this reflected at the pump in the form of uneasy price stability.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased slightly by 1.5 million bbl to 222.7 million bbl last week. Gasoline demand increased from 8.99 million b/d to 9.72 million b/d. Growing demand and tight supply would support more significant increases in pump prices, but fluctuations in the price of crude oil have helped to limit price increases. If oil prices climb, pump prices will likely follow suit.

Today’s national average of $3.28 is eight cents less than a month ago and $1.03 more than a year ago.

Quick Stats

The nation’s top 10 largest weekly changes: Oregon (+6 cents), Texas (+5 cents), New Mexico (+4 cents), Arizona (−4 cents), South Carolina (+3 cents), Washington. D.C. (+3 cents), Washington (+3 cents), Arkansas (+3 cents), Utah (−3 cents) and Delaware (−3 cents).

The nation’s top 10 most expensive markets: California ($4.65), Hawaii ($4.33), Washington ($3.88), Nevada ($3.83), Oregon ($3.82), Alaska ($3.70), Arizona ($3.61), Idaho ($3.56), Pennsylvania ($3.52) and Connecticut ($3.49).

Oil Market Dynamics

At the close of yesterday’s formal trading session, WTI increased by 87 cents to settle at $76.08. Despite demand concerns over the omicron variant of COVID-19, crude prices have increased since the EIA reported that total domestic oil stocks decreased by 3.6 million bbl last week to 420 million bbl. The current stock level is 14.9 percent lower than at the end of December 2020, contributing to domestic crude prices. This week, prices could continue to climb if EIA’s next weekly report shows another decrease in total stocks.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.

Source: AAA