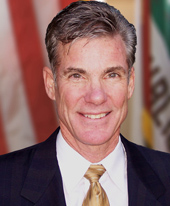

December 14, 2017 - Sacramento – State Superintendent of Public Instruction Tom Torlakson announced on Tuesday that he opposes changes in pending federal tax bills that could reduce the income of teachers and aspiring teachers at a time when  California faces a teacher shortage. A letter has been sent to the congressional members of the House Committee on Education regarding these bills.

California faces a teacher shortage. A letter has been sent to the congressional members of the House Committee on Education regarding these bills.

Current law lets teachers deduct $250 annually for paper, pencils, pens, and other classroom supplies, an assistance program that Congress created in 2002. The House Republican tax bill would scrap that deduction, and the Senate version would double it to $500. Congress must reconcile the tax proposals before sending a final bill to President Trump.

“The House bill is the wrong action at the wrong time,” Torlakson said. “It discourages people from joining or remaining in the teaching profession at a time when California needs to encourage qualified people to join or stay because our state is experiencing a significant teacher shortage.”

Any full-time instructor at a public or private school is eligible for the deduction. The Education Market Association reported that most teachers spent nearly $500 last year on supplies. The deduction is listed on tax forms alongside deductions for student loan interest, moving expenses, and health savings accounts. The House GOP bill also removes all those deductions.

In addition, the proposal to reauthorize the Higher Education Act that was recently introduced in the House of Representatives eliminates the Public Service Loan Forgiveness (PSLF) program, which allows for eventual loan forgiveness for student borrowers who take up careers in public service, including teachers. More than 500,000 college graduates have signed up for the program nationwide.

“Teachers play a pivotal role in helping young people become excited about learning and reaching success in 21st-Century careers and college,” said Torlakson, a former science teacher and coach. “Congress should encourage talented people to pursue careers in teaching and other public services, but this proposal does just the opposite. I urge Congress to retain the Public Service Loan Forgiveness program, and help alleviate the teacher shortage.”

According to the Learning Policy Institute, a nonprofit research institution, well-designed loan forgiveness programs can aid the recruitment and retention of talented teachers in high-need areas and locations.

Torlakson has made retaining and recruiting teachers a top priority. Last year, when he served as acting governor, Torlakson issued a proclamation designating July 26, 2016 as “Change Lives – Be a Teacher Day,” while urging qualified people to join the field.

California needs about 20,000 newly credentialed teachers a year. But for the past three years, starting in 2013-14, California has issued about 12,000 credentials, creating a shortfall of about 8,000, according to the Learning Policy Institute. Shortages are especially significant in the fields of math, science, special education, and bilingual education.

Source: CDE