November 15, 2019 - Millions of current enrollees in stand-alone Medicare Part D prescription drug plans will face premium and other cost increases next year unless they switch to lower-cost plans during the open enrollment period that began Oct. 15 and ends on Dec. 7, a new KFF analysis finds.

This includes two-thirds of Part D stand-alone drug plan enrollees not receiving low-income subsidies—nine million enrollees—who will face higher monthly premiums if they keep their current plan in 2020.

For instance, the 1.9 million enrollees without low-income subsidies in the Humana Walmart Rx plan—the third most popular stand-alone plan in 2019—will see their monthly premium more than double, on average, if they do not switch plans for 2020. That is because Humana is consolidating this plan and the Humana Enhanced plan into a new offering named Humana Premier Rx. Current Humana Walmart Rx enrollees will be automatically enrolled in the new plan, and, unless they switch, will see their monthly premium rise from $28 to $57.

While premiums for some other national plans are decreasing, enrollees in those plans may face other cost increases. For example, the 2.1 million enrollees without low-income subsidies in the nation’s largest stand-alone Part D plan, CVS Health’s SilverScript Choice, will see a modest $2 decrease in their average monthly premium, from $31 in 2019 to $29 in 2020. But the annual deductible in this plan will increase from $0 in most areas in 2019 to $215 to $435 in 2020—an increase that will more than offset the modest $2 monthly premium reduction.

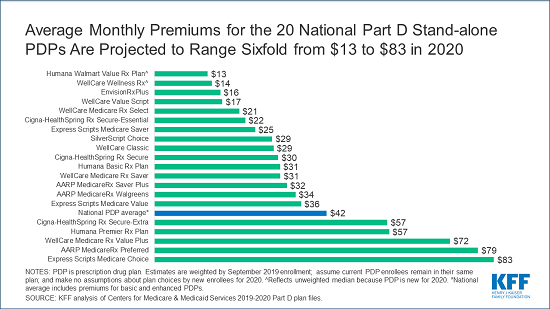

Overall, the analysis finds that premiums will vary widely across plans in 2020, as in previous years. Among the 20 stand-alone Part D plans available nationwide, average premiums will range sixfold, with the two lowest-premium plans charging $13 per month (Humana Walmart Value Rx) and $14 per month (WellCare Wellness Rx) and the two highest-premium plans charging $79 per month (AARP MedicareRx Preferred) and $83 per month (Express Scripts Medicare Choice). The estimated national average monthly PDP premium for 2020 is projected to increase by 7% to $42, based on current enrollment patterns. The actual national average premium in 2020 may be lower if current enrollees switch to, and new enrollees choose, lower-premium plans during open enrollment.

Among other key findings in Medicare Part D: A First Look at Prescription Drug Plans in 2020:

- The typical Medicare beneficiary will have a choice of 28 stand-alone drug plans next year, one more option than in 2019, and six more than in 2017.

- In 2020, nearly nine in 10 stand-alone drug plan enrollees are projected to be in plans operated by five firms: UnitedHealth, Humana, WellCare, CVS Health, and Cigna.

- There is a wide difference in cost sharing for generic and brand-name drugs, and most plans are charging the standard deductible of $435, unlike previous years. Among all stand-alone plans, median cost sharing is $0 for preferred generics and just $3 for generics, but $42 for preferred brands and 38 percent coinsurance for non-preferred drugs (the maximum allowed is 50%), plus 25 percent coinsurance for specialty drugs (the maximum allowed is 33%).

- Medicare beneficiaries receiving the Low-Income Subsidy (LIS) will have a choice of seven premium-free PDPs in 2020, on average, one more than in 2019. In 2020, nearly 20% of all LIS PDP enrollees who are eligible for premium-free Part D coverage (1.3 million LIS enrollees) will pay Part D premiums averaging $18 per month unless they switch or are reassigned by CMS to premium-free plans.

Forty-five million beneficiaries have prescription drug coverage through Medicare, including 20.6 million who are in stand-alone Part D plans as a supplement to traditional Medicare. The analysis provides an overview of stand-alone plans that will be available in 2020 and highlights key changes from prior years.

The analysis does not cover the 17.4 million people enrolled in Medicare Advantage prescription drug plans (non-employer) and another 4.6 million enrollees in employer-group only stand-alone plans and 2.3 million in employer-group only Medicare Advantage drug plans. Premiums and benefits data for these employer-group plans are not publicly available.

Also available are KFF’s newly updated basic resource, An Overview of the Medicare Part D Prescription Drug Benefit, and the recently released How Will The Medicare Part D Benefit Change Under Current Law and Leading Proposals?, which shows that some Part D enrollees can expect to see their out-of-pocket drug expenses rise in 2020.

Source: KFF