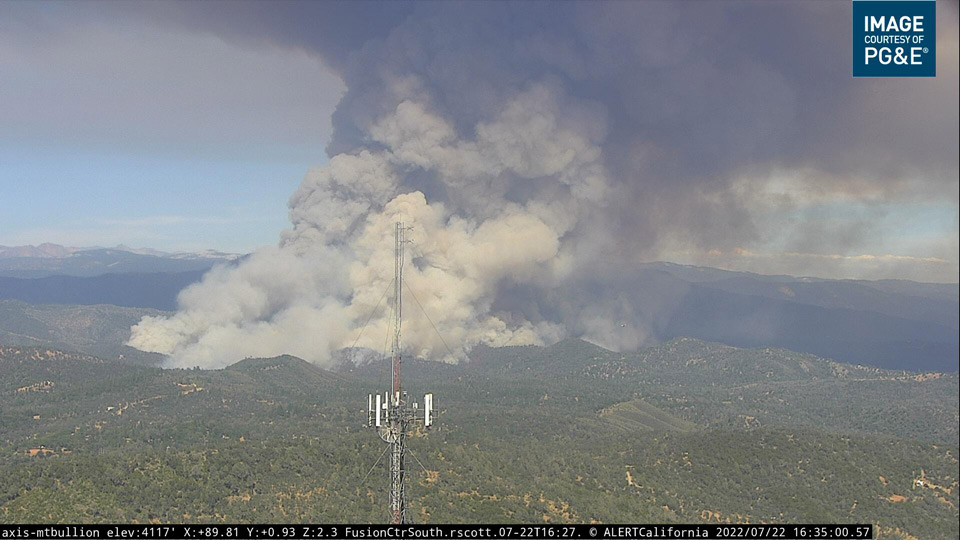

Mariposa County from the PG&E Mount Bullion Live Camera on Friday, July 22, 2022 at 4:35 P.M.

August 1, 2022 - SACRAMENTO, Calif. — As the Oak Fire continues to threaten homeowners, Insurance Commissioner Ricardo Lara today ordered insurance companies to preserve residential insurance coverage for the entire county of Mariposa after Governor Gavin Newsom issued an emergency declaration on July 23. The Commissioner’s Bulletin shields those properties within the perimeter or in adjacent ZIP Codes of the Oak Fire from insurance non-renewal or cancellation for one year from the date of the Governor’s July 23 declaration regardless of whether they suffered a loss. The Oak Fire has currently destroyed 124 homes and 66 outbuildings.

“Homeowners should not have to scramble to find fire insurance while suffering the effects of a wildfire,” said Commissioner Lara. “By taking this immediate action and forbidding insurance companies from issuing non-renewals and cancellations for one year, Mariposa County homeowners will have more time to get back on their feet. This is one part of a larger solution for consumers that includes working to expand insurance protections and increasing market competition to help protect consumers.”

Commissioner Lara’s ability to issue moratoriums is a result of a California law he authored in 2018 while serving as state senator in order to provide temporary relief from insurance non-renewals and cancellations to residents living within or adjacent to a gubernatorial-declared wildfire disaster.

Today’s moratorium order includes 11 ZIP codes impacting an estimated 8,000 residential policyholders and the entire county of Mariposa. Some policyholders in Madera and Merced counties are also affected.

Department staff are currently at the Local Assistance Center at Mariposa County High School assisting affected homeowners with their insurance questions. Consumers can go to the Department of Insurance website to see if their ZIP Code is included in the moratorium. Consumers should contact the Department of Insurance at 800-927-4357 or via chat or email at insurance.ca.gov if they believe their insurance company is in violation of this law, or have additional claims-related questions.

The Commissioner’s action is part of a larger solution he is pursuing for consumers and wildfire survivors that includes working to increase insurance protections and market competition to help protect consumers. Commissioner Lara’s actions since taking office in 2019 include:

- Announced “Safer from Wildfires,” a new insurance framework that incorporates wildfire safety measures to help save lives while making homes and businesses more resilient. Safer from Wildfires was created by a first-ever partnership between the Department of Insurance and the emergency and preparedness agencies in Governor Newsom’s Administration, including CAL FIRE, the Governor’s Office of Emergency Services (CalOES), the Governor’s Office of Planning and Research, and the California Public Utilities Commission.

- Proposed new regulations to incorporate Safer from Wildfires in insurance pricing, driving down costs for consumers who have taken actions to protect their communities while increasing transparency about their home’s or business’s “wildfire risk score.”

- Sponsored new insurance protections signed into law by Governor Newsom — despite opposition from insurance companies — that will mean larger payouts for some consumer claims, less red tape from insurance companies, and more help for people under evacuation orders.

- Ordered the FAIR Plan, the state’s insurer of last resort, to offer a more comprehensive homeowners policy as an option, which a judge recently upheld, as well as expanding residential and commercial coverage limits for the first time in 25 years to keep pace with increased costs.

Following Governor Newsom’s state of emergency declaration, the Department of Insurance partners with the Department of Forestry and Fire Protection (CAL FIRE) and the Governor’s Office of Emergency Services (CalOES), pursuant to existing statute, to identify wildfire perimeters for mandatory moratorium areas. The Department of Insurance will continue to collaborate with CAL FIRE and CalOES to identify additional wildfire perimeters for any fires where there is a declaration of a state of emergency.

Notes:

- The mandatory one-year moratorium announced today covers over 8,000 residential policies in ZIP Codes located within or adjacent to the Oak Fire under Senate Bill 824 (Lara, Chapter 616, Statutes of 2018), also known as the “Wildfire Safety and Recovery Act”.

- On July 23, 2022, Governor Newsom proclaimed a state of emergency covering Mariposa County due to the Oak Fire.

- While existing law prevents non-renewals and cancellations for those who suffer a total loss in areas subject to a declared disaster, the 2018 law established protection for those living within or adjacent to a declared wildfire emergency whether they suffer a loss or not — recognizing for the first time in law the disruption that non-renewals cause in communities following wildfire disasters. Homeowners who suffered a total property loss have up to 24 months of protection from non-renewal or cancellation.

- Consumers can go to the Department of Insurance website to find the Commissioner’s Bulletin to see if their ZIP Code is included in this moratorium.

Source: CA. Dept. of Ins.