Senators Elizabeth Warren and Sheldon Whitehouse: “Given the Department’s commitment to holding perpetrators of white collar crime personally accountable, we expect DOJ to investigate the actions leading to the collapse of FTX with the utmost scrutiny.”

November 27, 2022 - Washington, D.C. — United States Senators Elizabeth Warren (D-Mass.) and Sheldon Whitehouse (D-R.I.) sent a letter to the Department of Justice (DOJ) requesting  personal accountability for former FTX CEO Sam-Bankman Fried and any complicit FTX executives for wrongdoing following the cryptocurrency exchange’s swift collapse.

personal accountability for former FTX CEO Sam-Bankman Fried and any complicit FTX executives for wrongdoing following the cryptocurrency exchange’s swift collapse.

In early November, FTX, one of the world’s-largest crypto platforms, announced that it and more than 130 additional affiliated companies had filed for bankruptcy. This collapse has left hundreds of thousands of retail investors unable to access their funds and triggered a contagion across the industry. New and devastating details about FTX’s operations continue to emerge, including disturbing allegations of fraud and illicit behavior by FTX executives. John Jay Ray, FTX’s new CEO who previously managed Enron’s bankruptcy, stated that he has never seen “such a complete failure of corporate control.”

“The fall of FTX was not simply a result of sloppy business and management practices, but rather appears to have been caused by intentional and fraudulent tactics employed by Mr. Bankman-Fried and other FTX executives to enrich themselves,” wrote the lawmakers. “In fact, Mr. Bankman-Fried had already revealed his true interests of self-enrichment last year when he siphoned $300 million to his own wallet, an investment that was intended to ‘help grow (FTX), improve user experience and allow it to engage more with regulators.’”

Amid the breakdown, troubling allegations surfaced that Sam Bankman-Fried built a backdoor into FTX’s accounting processes that allowed him to secretly move billions of FTX customer funds out of FTX and into his trading firm, Alameda Research. There have also been reports that Bankman-Fried misled customers about the safety of their funds, and that FTX executives did not have appropriate records and security controls in place to track customer funds.

“As this situation unfolds, new facts will undoubtedly shed new light on how Bankman-Fried and his associates’ deception has harmed FTX’s customers, and customers of any company that was exposed to the contagion – and may reveal that the problems with the crypto industry extend well beyond FTX,” concluded the lawmakers.

The lawmakers point to DOJ’s recent commitment to “(hold) individuals accountable for white-collar crime, as opposed to only levying fines on companies” and “to increase its focus on the flesh-and-blood victims of white-collar wrongdoing.”

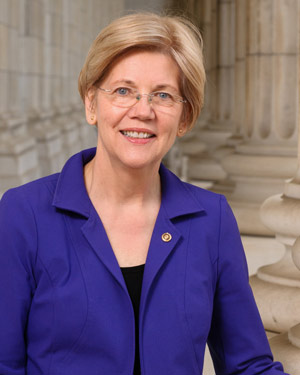

Senator Warren is an outspoken advocate for regulation and oversight of crypto to protect the environment, consumers, the energy grid, and the safety and stability of the financial system:

- On November 22, 2022, Senator Warren published an op-ed in the Wall Street Journal urging federal regulators to use their expansive authorities to crack down on crypto fraud and hold the industry to the same basic standards as other financial activities.

- On November 17, 2022, Senator Warren, along with Senator Dick Durbin (D-Ill.), sent a letter to Sam Bankman-Fried, founder and former CEO of FTX Trading Ltd. (FTX), and John Jay Ray III, the newly appointed CEO of FTX, seeking information on the reported misuse of billions of dollars of customer funds and other disturbing allegations that continue to emerge about the company’s fraudulent and illicit practices.

- On October 25, 2022, U.S. Senators Elizabeth Warren (D-Mass.) and Sheldon Whitehouse (D-R.I.) and U.S. Representatives Alexandria Ocasio-Cortez (D-N.Y.), Jesús “Chuy” García (D-Ill.), and Rashida Tlaib (D-Mich.) sent a letter to the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the U.S. Department of Treasury (Treasury), the Federal Reserve (Fed), the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB), seeking information about the steps each regulator is taking to stop the revolving door between financial regulatory agencies and the cryptocurrency industry.

- In September 2022, Senator Warren sent a letter to Treasury Secretary Janet Yellen calling on the Treasury Department (Treasury) and the Financial Stability Oversight Council (FSOC) to build a strong regulatory framework for the crypto market

- In July 2022, Senator Warren and her colleagues released the findings from an investigation into seven large cryptomining companies – showing extraordinarily high energy use and climate impacts from cryptomining – and called on the EPA and DOE to take action.

- In May 2022, Senators Warren and Tina Smith (D-Minn.), sent a letter to Fidelity, asking the company to explain its decision to allow Bitcoin investments for 401(k) plans, despite the Department of Labor’s warnings about 401(k) crypto investments.

- In March 2022, Senator Warren, Senate Armed Services Committee Chair Jack Reed (D-R.I.), Senate Intelligence Committee Chair Mark Warner (D-Va.), and Senate Defense Appropriations Subcommittee Chair Jon Tester (D-Mt.) introduced the Digital Asset Sanctions Compliance Enhancement Act to ensure that Vladimir Putin and Russian elites don't use digital assets to undermine the international community’s economic sanctions against Russia following its invasion of Ukraine.

- In March 2022, at a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren highlighted the various cryptocurrency tools that could make it easier for sanctioned individuals to hide their wealth and lessen the impact of Russian sanctions.

- In March 2022, at a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren warned that cryptocurrency may allow Russia to dodge sanctions and urged stronger regulation of the crypto market to ensure that countries, drug traffickers, cyber criminals, and tax cheats can’t evade economic pain.

- In March 2022, Senators Warren, Warner, Reed, and Sherrod Brown (D-Ohio), Chair of the Senate Banking, Housing, and Urban Affairs Committee, sent a letter to Treasury Secretary Janet Yellen, asking about the Treasury Department’s plans to enforce sanctions-compliance guidance for the cryptocurrency industry to ensure that economic sanctions remain an effective tool for achieving foreign policy goals.

- In December 2021, during a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren raised concerns over the growing risks presented by stablecoins.

- In September 2021, at a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren called on regulators to step up to address crypto's regulatory gaps and ensure an inclusive financial system.

- In July 2021, Senator Warren sent a letter to SEC Chair Gary Gensler requesting information about the agency's authority to regulate cryptocurrency exchanges and protect consumers from risks posed by the highly volatile cryptocurrency market.

- In June 2021, chairing a hearing of the Senate Banking, Housing, and Urban Affairs Committee's Subcommittee on Economic Policy, Senator Warren delivered remarks on the opportunities and risks that digital currencies present.

- In a June 2021 interview, Senator Warren called the market for cryptocurrencies the “wild west,” and said digital currency is “not a good way to buy and sell things and not a good investment and an environmental disaster.”

- In May 2021, Senator Warren and Representative Pramila Jayapal (D-Wash.) released "Rigged Justice 2.0," the second in a series of reports on the failure of the federal government to hold corporate and white-collar criminals accountable. The first in the series was released in February of 2016.

Text of Letter (PDF)

Source: Senator Elizabeth Warren