Access Current & Historical Data

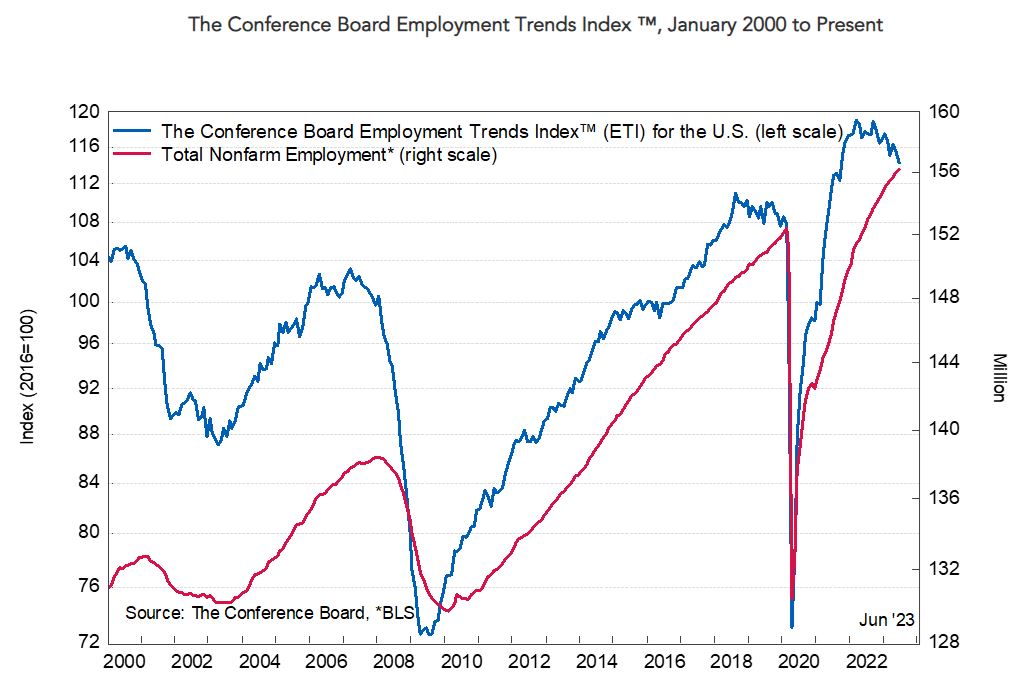

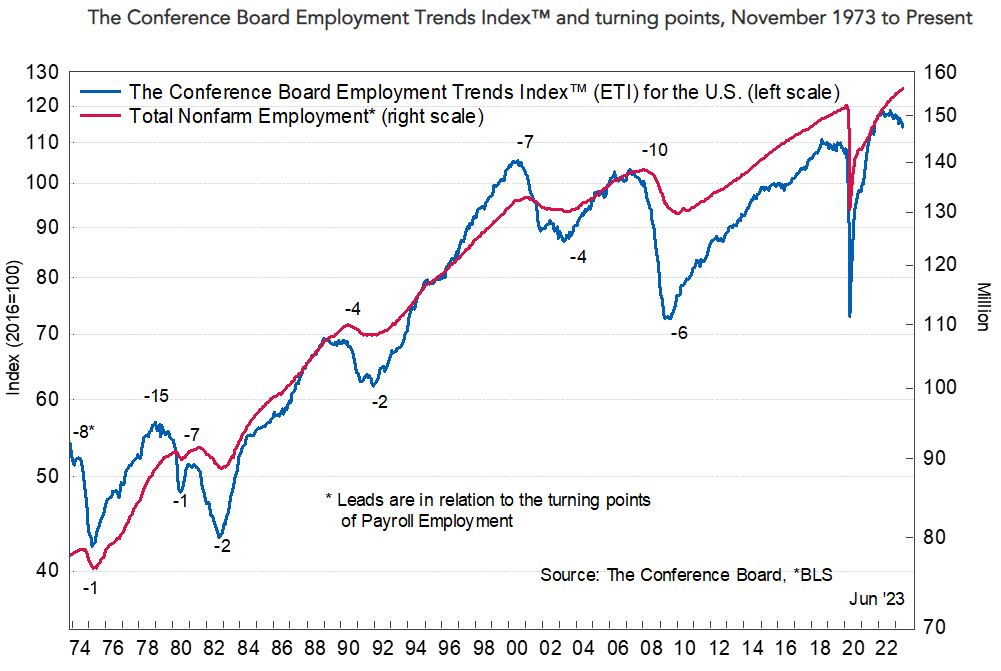

July 11, 2023 - The Conference Board Employment Trends Index™ (ETI) decreased in June to 114.31, from a downwardly revised 115.53 in May. The Employment Trends Index is a leading composite index for employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

“The ETI fell for the second consecutive month in June, signaling slower job growth in the coming months," said Selcuk Eren, Senior Economist at The Conference Board. “While the Index has been on a declining trend since March 2022, it remains quite elevated in a historical context. This suggests the US will continue adding jobs, just at a slower rate. We will need to see further declines in the ETI before predicting if—and when—employment growth will turn negative”.

Eren added: “We’re still in a very tight job market, especially compared to pre-pandemic conditions. While signs of cooling have emerged, they’re proceeding at a very slow pace. Among the components of the ETI, job openings have been trending downwards since the highs reached a year ago, but remain well above pre-pandemic levels. The number of employees working in temporary help services has been falling since November 2022. As an important early indicator for hiring, this previews slower job gains and eventually job losses in other industries. Looking ahead, we expect the Fed’s rate hikes to have a more visible negative impact on job growth by the end of 2023 and into the first half of 2024. By the middle of next year, we forecast the unemployment rate to peak at around 4.5 percent and labor force participation to fall to 62.1 percent—compared to current levels of 3.6 percent and 62.6 percent, respectively.”

June’s decrease in the Employment Trends Index was driven by negative contributions from five of its eight components: Ratio of Involuntarily Part-time to All Part-time Workers, Initial Claims for Unemployment Insurance, Percentage of Firms with Positions Not Able to Fill Right Now, Number of Employees Hired by the Temporary-Help Industry, and Industrial Production.

The Employment Trends Index aggregates eight leading indicators of employment, each of which has proven accurate in its own area. Aggregating individual indicators into a composite index filters out “noise” to show underlying trends more clearly.

The eight leading indicators of employment aggregated into the Employment Trends Index include:

- Percentage of Respondents Who Say They Find “Jobs Hard to Get” (The Conference Board Consumer Confidence Survey®)

- Initial Claims for Unemployment Insurance (U.S. Department of Labor)

- Percentage of Firms with Positions Not Able to Fill Right Now (© National Federation of Independent Business Research Foundation)

- Number of Employees Hired by the Temporary-Help Industry (U.S. Bureau of Labor Statistics)

- Ratio of Involuntarily Part-time to All Part-time Workers (BLS)

- Job Openings (BLS)*

- Industrial Production (Federal Reserve Board)*

- Real Manufacturing and Trade Sales (U.S. Bureau of Economic Analysis)**

*Statistical imputation for the recent month

**Statistical imputation for two most recent months

About The Conference Board

The Conference Board is the member-driven think tank that delivers trusted insights for what’s ahead. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.

Source: The Conference Board