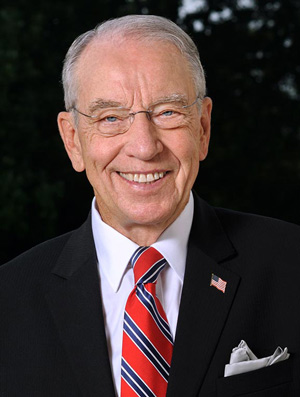

August 11, 2023 - BUTLER COUNTY, IOWA – Following reports that some nonprofit hospitals are using their tax status to restrict care  and increase patient costs, U.S. Sens. Chuck Grassley (R-Iowa) and Elizabeth Warren (D-Mass.) have called on the Treasury Inspector General for Tax Administration (TIGTA) and the Internal Revenue Service (IRS) to evaluate the hospitals’ compliance with tax-exempt requirements and provide information on oversight efforts. Grassley and Warren are joined by Sens. Raphael Warnock (D-Ga.) and Bill Cassidy (R-La.).

and increase patient costs, U.S. Sens. Chuck Grassley (R-Iowa) and Elizabeth Warren (D-Mass.) have called on the Treasury Inspector General for Tax Administration (TIGTA) and the Internal Revenue Service (IRS) to evaluate the hospitals’ compliance with tax-exempt requirements and provide information on oversight efforts. Grassley and Warren are joined by Sens. Raphael Warnock (D-Ga.) and Bill Cassidy (R-La.).

“We are alarmed by reports that despite their tax-exempt status, certain nonprofit hospitals may be taking advantage of this overly broad definition of ‘community benefit’ and engaging in practices that are not in the best interest of the patient,” the lawmakers wrote. “These practices – along with lax federal oversight – have allowed some nonprofit hospitals to avoid providing essential care in the community for those who need it most.”

Most community hospitals in the United States operate as private, nonprofit organizations. They can qualify for tax exemptions if they provide care to benefit their communities, consistent with IRS rules. 2020 exemptions totaled roughly $28 billion.

However, some nonprofit hospitals may be operating at the expense of the patients they’re accredited for serving – through wage garnishment, forcing payments by low-income patients and denying medical care. A 2023 study of over 1,700 nonprofit hospitals found “77 percent spent less on charity care and community investment than the estimated value of their tax breaks.”

Read the lawmakers' full letter HERE.

Background:

Grassley has long worked to hold nonprofit hospitals – namely the UVA Medical Center and Methodist Le Bonheur Healthcare – accountable for noncompliance with tax-exemption requirements. Grassley helped secure $16.9 million in debt forgiveness for over 3,000 patients after news outlets indicated a Missouri nonprofit medical center sued low-income patients who should have qualified for charity care.

Grassley has pressed federal agencies about related oversight, too. In 2018, he and then-chairman of the Finance Committee Orrin Hatch (R-Utah) wrote the IRS about its enforcement of tax-exempt criteria. Grassley continued to advance such efforts throughout his chairmanship.

Most recently, Grassley requested the Government Accountability Office (GAO) provide an update on IRS implementation of recommendations to improve processes for reviewing and auditing nonprofit hospitals’ community benefit activities. Read GAO’s response HERE.

Source: Senator Chuck Grassley