November 16, 2024 – LOS ANGELES, CA – California Attorney General Rob Bonta on Friday announced the unsealing of a grand jury indictment  against the owners of three mortgage brokerage firms and 11 affiliates in a mortgage fraud scheme. Fraudulent loan applications and financial documentation were allegedly used to obtain eight loans totaling $3.69 million. The fraudulent loans were then used by unsuspecting borrowers to purchase properties located in the counties of Los Angeles, Orange, Riverside, Sacramento, San Bernardino, and San Diego. 13 of the 14 total Defendants appeared in Los Angeles County Superior Court. 10 Defendents were arraigned on charges including mortgage fraud, receiving proceeds of mortgage fraud and grand theft and plead not guilty. The remaining defendents will be arrainged at a later date.

against the owners of three mortgage brokerage firms and 11 affiliates in a mortgage fraud scheme. Fraudulent loan applications and financial documentation were allegedly used to obtain eight loans totaling $3.69 million. The fraudulent loans were then used by unsuspecting borrowers to purchase properties located in the counties of Los Angeles, Orange, Riverside, Sacramento, San Bernardino, and San Diego. 13 of the 14 total Defendants appeared in Los Angeles County Superior Court. 10 Defendents were arraigned on charges including mortgage fraud, receiving proceeds of mortgage fraud and grand theft and plead not guilty. The remaining defendents will be arrainged at a later date.

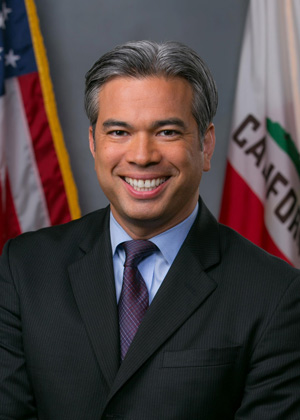

"Those who try to scam, defraud, or cheat Californians will be brought to justice," said Attorney General Rob Bonta. "Today, due to the hard work of our legal team and federal partners we're holding these scammers accountable for their crimes. Those who cheat the system and exploit the dream of homeownership to line their own pockets will be held responsible."

"Criminal acts of mail fraud, like those committed by First Republic Mortgage, not only taint the landscape of financial lending but it also put families at risk by potentially leaving them with unmanageable debt or financial hardship," said Los Angeles Division Inspector in Charge, Matt Shields. "The US Postal Inspection Service, along with our state and federal law enforcement partners, will continue to protect consumers from these deceptive schemes used by those involved to profit from these mail fraud related crimes."

The indictment charges the owner of First Republic Mortgage, the owner of 1st Fidelity Home Loans, and the owner of Coastline Properties, with allowing their associates to misuse their mortgage broker licenses to fraudulently secure home mortgage loans. Additionally, a defendant is accused of originating fraudulent loans by leveraging the licenses of owners for both First Republic Mortgage and Coastline Properties, while managing the operation from an office in Riverside. Furthermore, an escrow agent for 1st Fidelity Escrow is alleged to have used the license of 1st Fidelity Home Loans’ owner to facilitate fraudulent loans. The indictment also includes charges against various associates of these companies, along with several related real estate agents.

The California Attorney General’s Office joined various federal agencies, including the Federal Housing Finance Agency-Office of the Inspector General ("OIG"), the U.S. Department of Housing and Urban Development-OIG, and the United States Postal Inspection Service to investigate numerous mortgages originated by First Republic Mortgage, 1st Fidelity Home Loans, and Coastline Properties.

The investigation uncovered that the mortgage brokerages engaged in fraudulent activities against lenders during the origination of home loans. Some of the defendants are alleged to have submitted loan applications that contained inaccurate information regarding their clients' income, employment details, and, in certain cases, divorce documentation. Additionally, the firms provided lenders with falsified documents, including pay stubs, W-2 forms, alimony checks, and child support payments, in an effort to mislead lending institutions into approving and issuing mortgage loans. Some of the defendants profited from loan origination fees and other commissions derived from these home loans, which would not have been approved had the true information been disclosed. Clients placed their trust in the Defendants to secure a home loan, only to find themselves burdened with unexpectedly high mortgage payments and inaccurate documentation.

The Special Prosecutions Section of the California Department of Justice is prosecuting the case. DOJ’s Special Prosecution Section investigates and prosecutes complex criminal cases occurring in California, primarily related to financial, securities, mortgage, and environmental fraud; public corruption, including violations of California’s Political Reform Act; "underground economy" offenses, including tax and revenue fraud and counterfeiting; and human trafficking. Vertical teams of prosecutors, investigators, auditors, and paralegals often work with federal and local authorities on cases involving multi-jurisdictional criminal activity.

A copy of the indictment can be found here.

It is important to note that every defendant is presumed innocent until proven guilty.

Source: CA DOJ