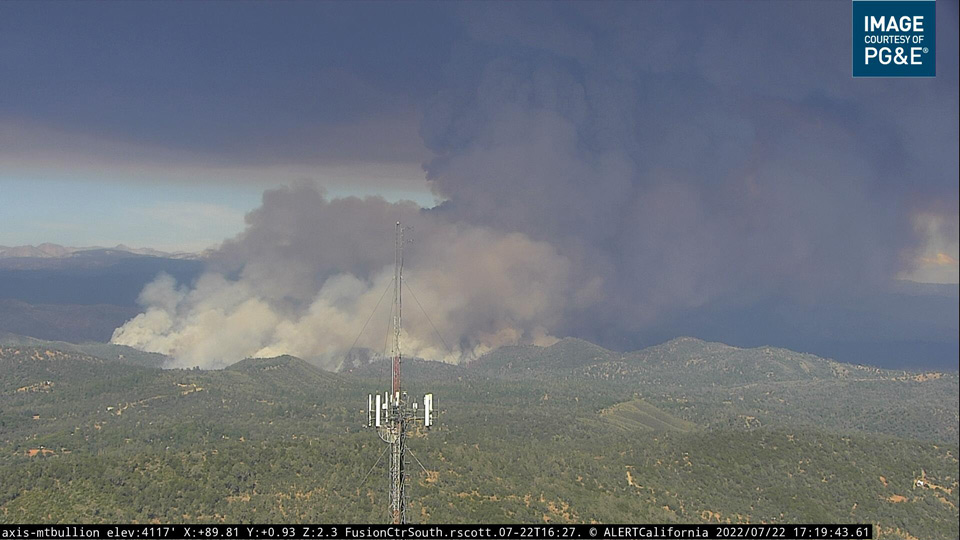

2022 Oak Fire in Mariposa County from the PG&E Mount Bullion Live Camera on Friday, July 22 at 5:20 P.M.

March 11, 2025 - LOS ANGELES — With sustained rains and an approaching atmospheric river increasing the risk of mudslides, Insurance Commissioner Ricardo Lara is reminding residents—especially those in wildfire-affected areas—that insurance companies are legally required to cover mudslides and debris flows if they result from recent fires that have destabilized hillsides.

“Protecting consumers is our main focus,” said Commissioner Lara. “With this atmospheric river on the way, communities recovering from wildfires face an even greater risk. It’s critical for Southern California residents to understand their insurance protections and take the necessary steps to secure the assistance they need. Those impacted should check their policies and seek help to make sure they receive the coverage they deserve.”

Wildfire-scorched landscapes, often referred to as “burn scars,” leave hillsides vulnerable to flash floods and debris flows. Without vegetation to absorb rainfall, water rapidly runs off, and extreme wildfire heat can create a water-repellent soil layer, further amplifying the risk. Even light rain can trigger dangerous flooding, especially in steep areas. Homes, roads, and infrastructure near recent burn area face heightened danger, often with little warning.

Many policyholders may not be aware that homeowners’ and commercial insurance policies typically exclude flood, mudslide, debris flow, and other similar disasters — unless they are directly or indirectly caused by a recent wildfire or another peril covered by the applicable insurance policy. The Department of Insurance has posted a fact sheet for consumers to answer questions about what their policies cover.

The Montecito mudslide in Santa Barbara County in January 2018 that followed the destructive Thomas Fire claimed 23 lives and caused more than $421 million in damage, according to Department of Insurance data. Following that disaster, the Governor enacted a new law to help prevent confusion about coverage following mudslides.

Commissioner Lara also urged consumers to take the following steps to prepare for the winter storm season:

- Use their smart phone to perform a home inventory to create a record of their belongings and store scans of important documents that they can easily access.

- Locate their insurance papers and put in a safe place or upload to an online location.

- For renters, consider purchasing renters’ insurance to protect their personal belongings, which typically are not covered by their landlord’s homeowners’ policy.

- Consider comprehensive auto insurance, which would protect their vehicle in the event of flood damage.

- Visit the Governor’s Office of Emergency Services (CalOES) “winter wise” web page to read more tips to prepare for winter weather.

- Consider flood insurance for future disasters in addition to their homeowners’ insurance policy. The National Flood Insurance Program currently provides the majority of flood coverage written in the state, but private flood insurance is also available. Flood insurance takes effect 30 days after it is purchased, except in the case of a home purchase where flood insurance is required by the lender.

The Department of Insurance can help consumers with insurance coverage or claim questions. Contact us at our consumer hotline at 800-927-4357 or through online chat or email at insurance.ca.gov.

Notes: