August 5, 2025 - WASHINGTON – On Monday, U.S. Senators John Cornyn (R-TX), Chris Coons (D-DE), Bill Cassidy (R- LA), and Catherine Cortez Masto (D-NV) introduced the No Tax Treaties for Foreign Aggressors Act, which would require the U.S. Department of the Treasury to terminate the U.S.-China Tax Treaty within 30 days of a Presidential determination that China has initiated an armed attack on Taiwan:

LA), and Catherine Cortez Masto (D-NV) introduced the No Tax Treaties for Foreign Aggressors Act, which would require the U.S. Department of the Treasury to terminate the U.S.-China Tax Treaty within 30 days of a Presidential determination that China has initiated an armed attack on Taiwan:

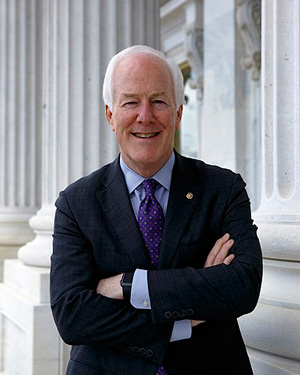

Senator John Cornyn (R-TX)

“The Chinese Communist Party must face dire consequences should it initiate an attack on Taiwan,” said Sen. Cornyn. “By ending the U.S.-China Tax Treaty if the Chinese Communist Party invades Taiwan, this legislation would inflict rightful financial pain on Beijing, and I urge my colleagues to support it.”

“Taiwan is on the front lines of our fight to ensure a free and open Indo-Pacific, and its security is critical to our own economy and security,” said Sen. Coons. “I’ve seen first-hand that China is becoming increasingly aggressive toward Taiwan in the South China Sea. That’s why I’m proud to be a part of this bipartisan legislation to make it clear to China that if it attacks, we will stand with our partners, and ensure swift and severe consequences.”

“Aggression against U.S. allies has consequences—this bill is one of them,” said Dr. Cassidy.

“The United States must stand strong with our allies in the Indo-Pacific against the threat of the expansionist Chinese Communist Party,” said Sen. Cortez Masto. “It is our duty to defend democracy at home and abroad, and there should be swift and concrete consequences if China attacks Taiwan.”

Congressman Tony Gonzales (TX-23) led companion legislation in the U.S. House of Representatives.

Background:

Multinational companies and individuals often face tax issues that arise in jurisdictions with differing laws. To clarify which countries can tax what income and when, bilateral and multilateral tax treaties commit countries to playing by the same set of rules. These tax treaties are modeled after the U.S. Model Income Tax Convention and facilitate trade and investment by eliminating double taxation, lowering certain withholding taxes, and creating certainty for businesses when they are making investment decisions.

Former President Ronald Reagan’s administration negotiated the U.S.-China Tax Treaty, which was ratified by the Senate in 1986 and includes a provision (Article 28) that allows either country to terminate it with six months’ notice. This legislation would instruct the Treasury Department to do so should China invade Taiwan as they have threatened to do by 2027.

Source: Senator John Cornyn