Image by PublicDomainPictures from Pixabay

Stronger views of the present situation mostly offset weaker expectations

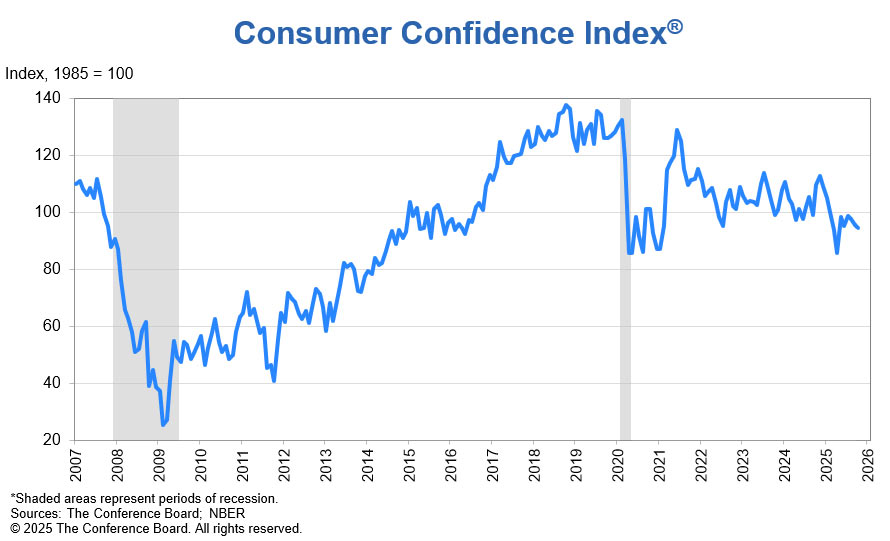

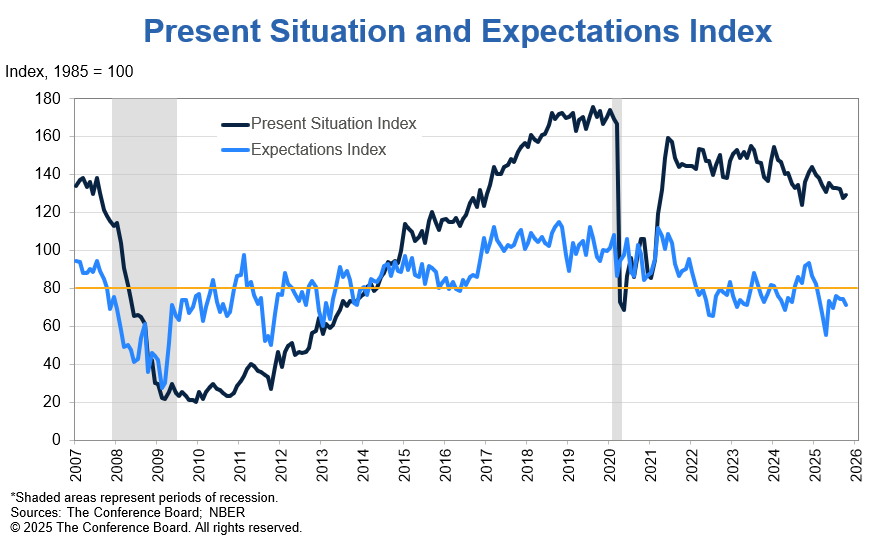

October 29, 2025 - The Conference Board Consumer Confidence Index® inched down by 1.0 point in October to 94.6 (1985=100) from an upwardly revised 95.6 in September. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—gained 1.8 points to 129.3. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—declined by 2.9 points to 71.5. Expectations have been below the threshold of 80 that typically signals a recession ahead since February 2025. The cutoff date for preliminary results was October 19, 2025.

“Consumer confidence moved sideways in October, only declining slightly from its upwardly revised September level,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “Changes to the individual subcomponents were also limited and largely cancelled each other out. The Present Situation Index regained some strength after September’s drop. Consumers’ view of current business conditions inched upward, while their appraisal of current job availability improved for the first time since December 2024. On the other hand, all three components of the Expectations Index weakened somewhat. Consumers were a bit more pessimistic about future job availability and future business conditions while optimism about future income retreated slightly.”

Among demographic groups, confidence declined for consumers under 35 years old and, to a lesser extent, among consumers over 55. Confidence improved for consumers aged 35 to 54. By income, confidence fell for consumers making less than $75K a year, but improved for most of the income groups making more than $75K, with the largest increase among those earning over $200K. Younger consumers and consumers earning over $75K have been the most optimistic overall. By partisan affiliation, confidence improved among Independents, declined among Democrats, and was also slightly down among Republicans.

Guichard added: “Consumers’ write-in responses were led by references to prices and inflation, which continued to be the main topic influencing consumers’ views of the economy. References to tariffs declined further this month but remained elevated. Mentions of jobs and employment eased somewhat after picking up in September. The write-in comments remained mostly negative overall, but less so than in previous months. References to US politics were up notably, with the ongoing government shutdown mentioned multiple times as a key concern.”

Consumers’ average 12-month inflation expectations remained somewhat elevated, inching up to 5.9% in October from 5.8% in September. The share of consumers expecting interest rates to riseticked up to 52.8% from 51.1% in September; meanwhile, 26.2% of consumers expected interest rates to decline, down from 26.9%. Consumers’ outlook for stock prices remained strong. Nearly half of consumers (49.9%, unchanged from September) expected stock prices to increase over the next 12 months, while just 28.5% of consumers expected stock prices to decline (up from 27.4% in September).

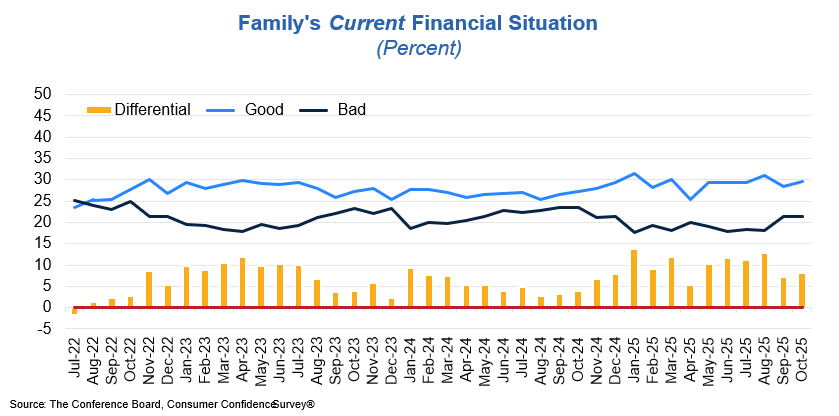

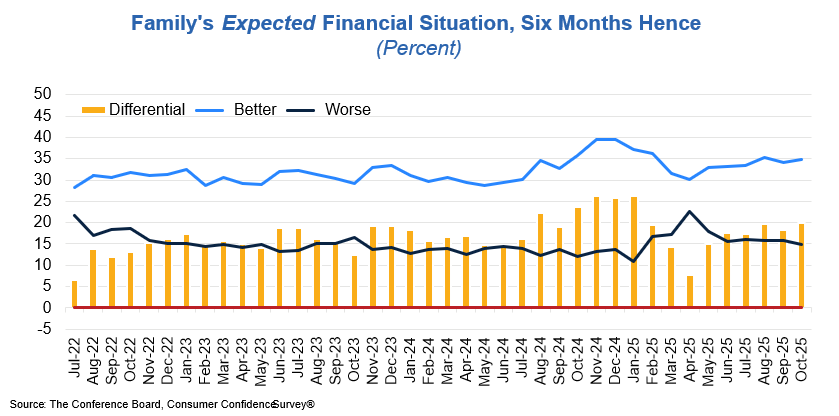

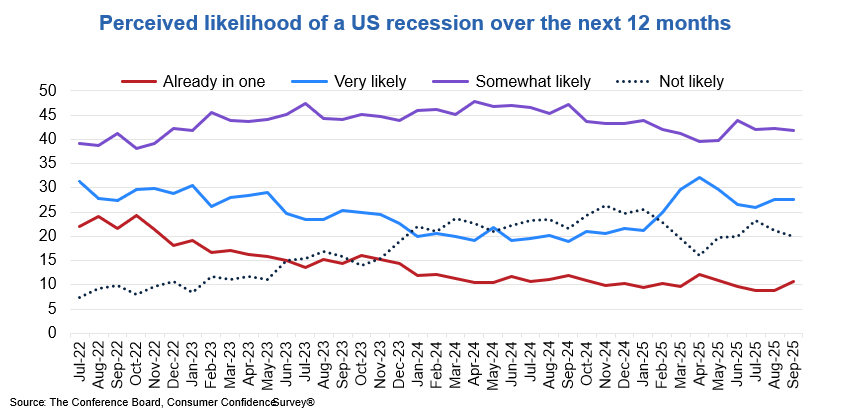

Consumers’ views of their Family’s Current and Future Financial Situation both improved in October. Despite October’s gains, consumers’ views of their current financial situation remained below their average level in 2025. The share of consumers who think a recession is very likely over the next 12 months declined in October, but the share of consumers thinking that the economy was already in recession increased for a third straight month. (These measures are not included in calculating the Consumer Confidence Index®).

Purchasing plans for cars increased in October, driven by plans to buy used cars.Meanwhile, purchasing plans for homes weakened for the month, but the overall six-month trend is rising.Consumers’ plans to buy big-ticket items were little changed overall, with a lot of variation across different types of appliances and electronic goods. Still, overall, plans to buy big-ticket items have started to pick after weakening earlier in the year. Meanwhile, consumers’ intentions to purchase more services ahead rose after September’s pullback, driven by pet care, streaming & internet, and motor vehicle services. Travel plans were also up, matching an increase in vacation intentions, which may be poised for recovery.

Preliminary data suggest that consumers’ holiday spending will be down this season compared to last year. Notably consumers expect to spend 3.9% less on gifts and 12% less on non-gifts (all in nominal terms). When asked what will be driving their spending decisions over the upcoming holidays, consumers most frequently cited promotions and getting the most out of every dollar. In addition to promotions, consumers also indicated that they will likely buy fewer goods if the price of imported items is inflated by tariffs. While some consumers started their holiday shopping as early as the first quarter of 2025, there was little evidence of advance purchasing ahead of tariffs. Most purchases are expected to take place between October and the end of the year, with November seeing the largest share of planned spending.

Present Situation

Consumers’ assessments of current business conditions improved in October.

- 20.2% of consumers said business conditions were “good,” up from 19.9% in September.

- 14.7% said business conditions were “bad,” down from 15.3%.

Consumers’ views of the labor market also improved in October.

- 27.8% of consumers said jobs were “plentiful,” up from 26.9% in September.

- Still, 18.4% of consumers said jobs were “hard to get,” up from 18.2%.

Expectations Six Months Hence

Consumers were a bit more pessimistic about future business conditions in October.

- 19.0% of consumers expected business conditions to improve, down from 19.3% in September.

- 22.6% expected business conditions to worsen, unchanged from last month’s revised reading.

Consumers were more worried about the labor market outlook in October.

- 15.8% of consumers expected more jobs to be available, down from 16.6% in September.

- 27.8% anticipated fewer jobs, up from 25.7%.

Consumers’ outlook for their income prospects was slightly less positive in October.

- 17.9% of consumers expected their incomes to increase, down from 18.2% in September.

- 12.5% expected their incomes to decrease, up from 11.7%.

Assessment ofFamily Finances and Recession Risk

- Consumer assessments of their Family’s Current Financial Situation improved in October after dropping in September.

- Consumer assessments of their Family’s Expected Financial Situation also improved.

- Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months declined in October, but more consumers thought a recession had already started.

The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was October 19.

Source: October 2025 Consumer Confidence Survey®

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org.

Source: The Conference Board