Auto Loan Balances Continue Rising; Younger Borrowers Struggle With Auto Debt Delinquencies

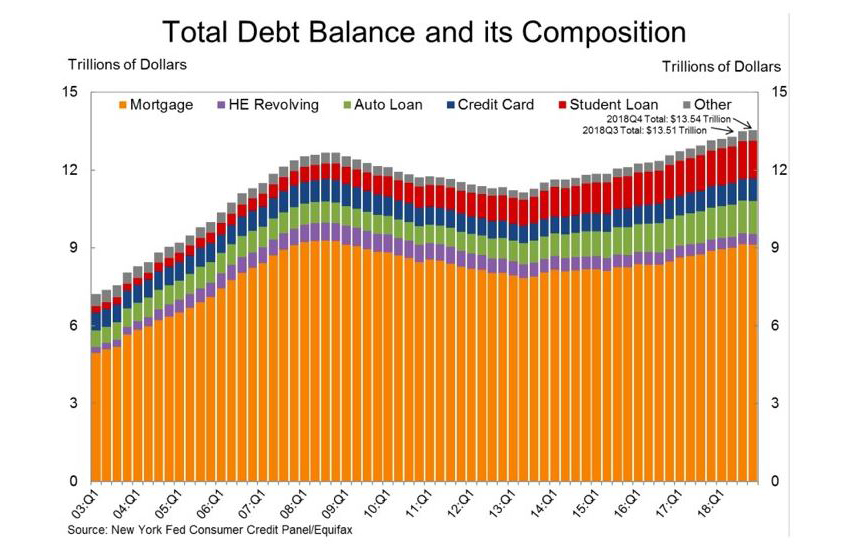

February 19, 2019 - NEW YORK—The Federal Reserve Bank of New York’s Center for Microeconomic Data last week issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $32 billion (0.2%) to $13.54 trillion in the fourth quarter of 2018. It was the 18th consecutive quarter with an increase and the total is now $869 billion higher than the previous peak of $12.68 trillion in the third quarter of 2008. Furthermore, overall household debt is now 21.4% above the post-financial-crisis trough reached during the second quarter of 2013. The Report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

The New York Fed also issued an accompanying blog post, which examines trends in auto loan debt performance by borrowers’ credit scores, age, and lender type.

“Auto loan originations for 2018 reached an all-time high in our dataset and the growth has been driven by creditworthy individuals. Despite auto debt’s increasing quality, its performance has been slowly worsening,” said Joelle Scally, Administrator of the Center for Microeconomic Data at the New York Fed. “Growing delinquencies among subprime borrowers are responsible for this deteriorating performance, and younger borrowers are struggling most acutely to afford their auto loans.”

The report includes a one-page summary of key takeaways and their supporting data points. Overarching trends from the Report’s summary include:

Housing Debt

- Mortgage originations declined to $401 billion from $445 billion, the lowest level seen in nearly four years.

- Mortgage delinquencies were roughly flat, with 1.1% of mortgage balances 90 or more days delinquent.

Non-Housing Debt

- Outstanding student loan debt increased to $1.46 trillion from $1.44 trillion.

- There were $144 billion in newly originated auto loans, continuing the nine-year growth trend. In fact, auto loan originations totaled $584 billion in 2018, the highest year in the 19-year history of the data for auto loan originations (in nominal terms).

- Credit card balances rose by $26 billion to $870 billion. The increase in credit card balances is consistent with seasonal patterns but marks the first time credit card balances re-touched the 2008 nominal peak.

Bankruptcy Notations, Collection Accounts, and Credit Inquiries

- About 195,000 consumers had a bankruptcy notation added to their credit reports, five thousand fewer than in the fourth quarter of 2017.

- The number of credit inquiries within the past six months – an indicator of consumer credit demand – declined to the lowest level seen in the history of the data.

- Account closings were at their highest level since 2010.

Household Debt and Credit Developments as of Q4 2018

*Change from Q3 2018 to Q4 2018

**Change from Q4 2017 to Q4 2018

Flow into Serious Delinquency (90 days or more delinquent) 1

1 Annualized as a four-quarter moving sum.

2 Rates represent annualized shares of balances transitioning into delinquency. Flow into serious delinquency is computed as the balances that have newly become at least 90 days late in the reference quarter divided by the balances that were current of less than 90 days past due in the previous quarter.

3 As explained in a previous report, delinquency rates for student loans are likely to understate effective delinquency rates because about half of these loans are currently in deferment, in grace periods or in forbearance and therefore temporarily not in the repayment cycle. This implies that among loans in the repayment cycle delinquency rates are roughly twice as high.

About the Report

The Federal Reserve Bank of New York’s Household Debt and Credit Report provides unique data and insight into the credit conditions and activity of U.S. consumers. Based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data, the report provides a quarterly snapshot of household trends in borrowing and indebtedness, including data about mortgages, student loans, credit cards, auto loans and delinquencies. The report aims to help community groups, small businesses, state and local governments and the public to better understand, monitor and respond to trends in borrowing and indebtedness at the household level. Sections of the report are presented as interactive graphs on the New York Fed’s Household Debt and Credit Report web page and the full report is available for download.

Source: New York Fed