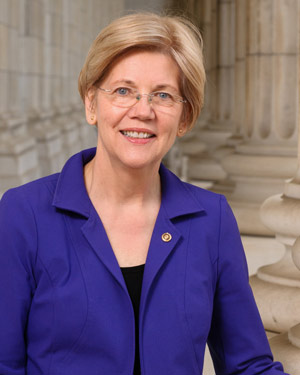

September 24, 2023 - Washington, D.C. – United States Senator Elizabeth Warren (D-Mass.) has released the following statement on Vice President’s Harris’s announcement that the  Consumer Financial Protection Bureau (CFPB) is starting a rulemaking process to remove medical bills from Americans’ credit reports.

Consumer Financial Protection Bureau (CFPB) is starting a rulemaking process to remove medical bills from Americans’ credit reports.

“Vice President Harris is leading the fight to lower costs for hardworking Americans by addressing the burden of medical debt. No one should have their credit ruined because of a medical emergency,” said Senator Warren. “By proposing to erase medical debt from credit reports, the CFPB is doing what the consumer agency does best: saving Americans money.”

The CFPB’s medical debt rulemaking includes proposals that, if finalized, would:

- Remove medical bills from consumers’ credit reports: Consumer reporting companies would be prohibited from including medical debts and collection information on consumer reports that creditors use in making underwriting decisions.

- Stop creditors from relying on medical bills for underwriting decisions: The proposal would narrow the 2005 exception and ensure that creditors only consider non-medical information when evaluating borrowers’ loan applications.

- Stop coercive collection practices: As unpaid medical bills would no longer appear on consumers’ credit reports used by creditors in making underwriting decisions, debt collectors would no longer be able to use the credit reporting system as leverage to pressure consumers into paying questionable debts.

Senator Warren has led the fight to protect consumers from medical debt, including:

- In June 2023, Senators Warren, Edward J. Markey (D-Mass.), and Bernie Sanders (I-Vt.) released the findings from their investigations into medical credit cards, which found that they can pose significant threats to patients’ finances. The senators sent a letter to the Director of the Consumer Financial Protection Bureau (CFPB) Rohit Chopra, urging the CFPB to initiate rulemaking to eliminate deferred interest and address other consumer risks from medical credit cards.

- In April 2023, at a hearing of the Senate Banking, Housing, and Urban Affairs, Senator Warren questioned the CEOs of Equifax, TransUnion, and Experian on the unreliability of medical debt data and its consequences for Americans’ creditworthiness. Senator Warren also pressed the agencies on their willingness to exclude medical debt data from future consumers’ reports, citing research showing that medical collections are less predictive of consumers’ future delinquency rates than nonmedical debt collections.

- In March 2023, chairing her first hearing of the Senate Armed Services Subcommittee on Personnel, Senator Warren highlighted the importance of putting pressure on the Department of Defense (DoD) to exercise its authority to waive civilian medical debt.

- In March 2023, Senator Warren sent a letter to DoD Secretary Lloyd Austin, requesting information from DoD about its efforts to implement recommendations from the CFPB’s Office of Servicemember Affairs’ Annual Report to address servicemember medical debt.

- In March 2023, Senator Warren and Representative Joaquin Castro (D-Texas) sent a letter to DoD Assistant Secretary for Health Affairs Dr. Lester Martinez-Lopez and Director of the Defense Health Agency Lieutenant General Telita Crosland, urging the agency to waive civilian patients’ medical debts incurred at military treatment facilities, using statutory authority established by the lawmakers’ provision in the Fiscal Year (FY) 2021 National Defense Authorization Act.

- In December 2022, Senators Warren and Markey led their colleagues in sending letters to Synchrony Bank and Wells Fargo, raising concerns about their medical credit cards and the potential financial harm they may inflict on patients.

- In December 2022, at a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren asked Director Chopra about the CFPB’s achievements over the last year to hold big banks and giant corporations accountable and put money back in working families’ pockets. The Senator asked Director Chopra about the Bureau’s work to eliminate junk fees, take on deceptive student loan servicers and shoddy tenant screening services, and eliminate medical collection debt from consumers’ credit reports.

- In August 2022, Senator Warren and Representative Castro sent a letter to Secretary Austin, raising concerns that DoD may be misleading or misinforming civilians about debt they incur when they receive emergency medical care at military health care facilities, and calling for improved billing practices to protect patients.

- In March 2022, Senator Warren joined Senator Sherrod Brown (D-Ohio) in sending a letter to Director Chopra, highlighting the growing medical debt burden faced by consumers. They urged the CFPB to use its authority to address the growing medical debt burden faced by consumers and establish an ombudsman position for consumer medical debt.

- The FY 2021 National Defense Authorization Act included Senator Warren's provision, based on the Financial Relief for Civilians Treated at Military Hospitals Act, to give DoD the authority to waive medical debt when the civilian is unable to pay the costs of the care provided and the care enhances the knowledge, skills, and abilities of military healthcare providers.

- In January 2020, Senator Warren sent a letter to DoD and the Treasury Department, requesting information about the collection of military hospital debt from low-income, civilian patients.

Source: Senator Elizabeth Warren