Every student loan servicer—EdFinancial, Maximus, MOHELA, and Nelnet—failed to prepare for the return to repayment, harming millions of borrowers across the country

Report – Servicing Scandals: Student Loan Servicers’ Failures During Return to Repayment

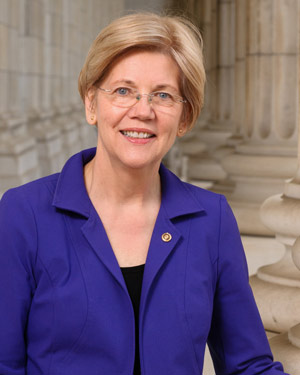

April 11, 2024 - Washington, D.C. — On Wednesday, U.S. Senators Elizabeth Warren (D-Mass.), Richard Blumenthal (D-Conn.), Edward J. Markey (D- Mass.), and Chris Van Hollen (D-Md.) released a new report: Servicing Scandals: Student Loan Servicers’ Failures During Return to Repayment, which reveals a decades-long pattern of student loan servicer incompetence and misconduct that has affected millions of borrowers nationwide. The report examines servicer failures during the return to repayment and how these countless billing errors and customer service problems harmed borrowers. The report comes as Senator Warren chairs a hearing today of the Senate Banking, Housing, and Urban Affairs Committee’s Subcommittee on Economic Policy on MOHELA’s performance as a student loan servicer.

Mass.), and Chris Van Hollen (D-Md.) released a new report: Servicing Scandals: Student Loan Servicers’ Failures During Return to Repayment, which reveals a decades-long pattern of student loan servicer incompetence and misconduct that has affected millions of borrowers nationwide. The report examines servicer failures during the return to repayment and how these countless billing errors and customer service problems harmed borrowers. The report comes as Senator Warren chairs a hearing today of the Senate Banking, Housing, and Urban Affairs Committee’s Subcommittee on Economic Policy on MOHELA’s performance as a student loan servicer.

The report includes new information about loan servicers' performance during the return to repayment provided by the Department of Education and from loan servicers' responses to Congressional inquiries. This data indicated that, in total, servicers made more than 3.9 million billing-related errors during the return to repayment.

“It’s clear that all servicers misled borrowers and screwed up the resumption of student loan repayments, making a whopping 3.9 million errors,” said Senator Warren. “For decades, loan servicers misled and harmed borrowers who have done everything right. It’s time for real action and accountability.”

“The findings of this report paint a harrowing picture, and borrowers deserve justice—these servicers must remedy these harms and resolve this nightmare for borrowers. Student loan debt in the United States is more than $1.6 trillion dollars, impacting over 42 million Americans. For too long, student loan servicers have harmed borrowers with deceitful tactics, including incorrect and late billing statements, low quality customer service, slow processing times, and an overall lack of transparency,” said Senator Blumenthal.

“Rampant student loan servicing errors have left millions of borrowers confused about how much they owe and when. These student loan servicers are further proving to the American people the absurdity of saddling students who are working to achieve their educational dreams with expensive and burdensome loans. We must work towards a world where students don’t have to worry about taking on any debt at all. In the meantime, the Biden administration needs to take steps to ameliorate the harm that these servicers have inflicted on borrowers,” said Senator Markey.

“Millions of Americans struggle under the weight of student debt, hindering their opportunities and holding back our entire economy. And as this report shows, systemic incompetence and mismanagement across the student loan servicing industry spanning many years – as well as the millions of billing errors that have occurred since the return to repayment after the pandemic pause – have only made things harder for these Americans. The Biden Administration has made critical improvements through their new industry accountability measures, but we must do more to help those who have been impacted by servicers’ failures and to ensure that their actions don’t hinder the Administration’s work to provide relief to millions of borrowers,” said Senator Van Hollen.

The report found that every single student loan servicer—EdFinancial, Maximus, MOHELA, and Nelnet—failed to adequately prepare for the transition back to repayment despite numerous warnings and federal funds throughout the payment pause. As a result, millions of borrowers experienced billing-related errors and poor customer service, made unnecessary payments, and were denied debt relief due to servicing mistakes.

The report calls for a clear path to cancel debt for borrowers who are harmed by servicer failures as the Department of Education works through the rulemaking process for student debt cancellation under the Higher Education Act.

Key findings from the report include:

- Student Loan Servicers Have a Decades-Long Pattern of Failures. The COVID-19 pandemic exacerbated and highlighted a decades-long problem: lack of accountability allowed student loan servicers’ abuses to go unchecked and caused harm for borrowers crushed by student loan debt.

- Servicers Failed Borrowers During the Return to Repayment. After a three-year pause on student loan payments, collections, and interest due to the COVID-19 pandemic, borrowers were required to resume payments on their loans starting in October 2023. But servicers failed to adequately prepare. As a result, millions of borrowers experienced countless billing errors and customer service problems. In total, servicers made more than 3.9 million billing-related errors during the return to repayment. Data revealed high call wait and email response times, with one servicer reporting a six-week average email response time; call abandonment rates reaching as high as 48.2% during the return to repayment; and customer service ratings that repeatedly fell below ED’s required thresholds.

- The Biden-Harris Administration Responded to Servicer Failures and Strengthened the Student Loan Servicing System. The Biden-Harris Administration improved accountability metrics for servicers that prioritized the borrower’s customer service experience, provided temporary protections for borrowers during return to repayment—like requiring servicers to place borrowers affected by their errors into short administrative forbearance while they fix the problem—and held servicers accountable when they failed. While the Biden-Harris Administration has taken aggressive action to protect borrowers, it can do more by providing additional pathways to cancel student debt for victims of servicer error.

Senator Warren has been an outspoken advocate on student debt relief:

- In March 2024, Senators Elizabeth Warren (D-Mass.) and Ron Wyden (D-Ore.), Chair of the Senate Finance Committee, along with U.S. Representatives Ayanna Pressley (D-Mass.), Pramila Jayapal (D-Wash.), Raúl Grijalva (D-Ariz.), and John Larson (D-Conn.), led their colleagues in calling on the Social Security Administration (SSA), the U.S. Department of the Treasury (Treasury), and the U.S. Department of Education (ED) to end the practice of offsetting Social Security benefits to pay off defaulted student loans.

- In March 2024, Senator Elizabeth Warren sent a letter to the CEO of MOHELA inviting him to testify before Congress to explain MOHELA’s handling of student loan borrowers’ experience with return to repayment and the Public Service Loan Forgiveness (PSLF) program.

- In February 2024, Senator Warren, Majority Leader Chuck Schumer (D-N.Y.), and Senator Bernie Sanders (I-Vt.) released the following statement calling for an investigation into student loan mismanagement by MOHELA.

- In January 2024, Senators Warren, Schumer, Sanders, Senator Raphael Warnock (D-Ga.), and Senator Alex Padilla (D-Calif.), along with Representative Ayanna Pressley (D-Mass.), Assistant Democratic Leader Jim Clyburn (D-S.C.), Representative Frederica Wilson (D-Fla.), and Representative Ilhan Omar (D-Minn.), led their colleagues in calling on the Secretary of Education Miguel Cardona to host a fourth session of the student debt negotiated rulemaking to consider relief for borrowers experiencing financial hardship.

- In December 2023, U.S. Senators Warren, Richard Blumenthal (D-Conn.), Ed Markey (D-Mass.), and Chris Van Hollen (D-Md.) sent follow-up letters to student loan servicers – MOHELA, EdFinancial, Nelnet, and Maximus – raising concerns about borrowers’ problems with return to repayment, requesting information about the borrower experience, and pushing back on the servicers’ claim that budget shortfalls limit their ability provide quality customer service to millions of borrowers.

- In December 2023, Senators Warren, Schumer, Sanders, Alex Padilla (D-CA), and Representatives Ayanna Pressley (D-Mass.), Ilhan Omar (D-Minn.), and Frederica Wilson (D-Fla.) sent a letter to U.S. Secretary of Education Miguel Cardona, urging him to leverage his existing and full authority under the Higher Education Act to provide expanded student debt relief to working and middle-class borrowers.

- In December 2023, Senators Warren, Sanders, Blumenthal, and Van Hollen, sent a letter to Secretary Miguel Cardona of the Department of Education, outlining concerns about its management of the return to student debt repayment. With the resumption of student loan payments underway since October 2023, the lawmakers are requesting information on the Department’s efforts to minimize student loan servicers’ errors and protect borrowers.

- In November 2023, Senators Edward J. Markey (D-Mass.), Elizabeth Warren (D-Mass.) led their colleagues Senators Chris Van Hollen (D-Md.) and Richard Blumenthal (D-Conn.) in sending a letter to Scott Giles, chief executive officer of the Higher Education Loan Authority of Missouri (MOHELA), demanding that the loan servicer immediately update borrowers on its most recent error that resulted in 2.5 million borrowers placed into administrative forbearance.

- In September 2023, Senators Warren, Richard Blumenthal (D-Conn.), Ed Markey (D-Mass.), and Chris Van Hollen (D-Md.) sent a letter to four federal loan servicers – MOHELA, Nelnet, EdFinancial, and Maximus Federal Services Inc. – requesting updated information about their readiness to serve borrowers amid recent reports of servicing problems, and pushing back on their claims that budget shortfalls could limit their ability to help borrowers since servicers received billions in federal funding throughout the pandemic. The lawmakers are also released responses from the servicers to their July 2023 letter.

- In August 2023, Senator Warren, Congresswoman Ayanna Pressley (D-Mass.), Senate Majority Leader Chuck Schumer (D-N.Y.), Senators Alex Padilla, (D-Calif.), and Raphael Warnock (D-Ga.) and U.S. Representatives Ilhan Omar (D-Minn.), Jim Clyburn (D-S.C.), and Frederica Wilson (D-Fla.) led 79 other lawmakers in a letter to President Joe Biden, urging him to swiftly deliver on his promise to deliver student debt cancellation to working and middle class families by early 2024.

- In April 2023, Senator Warren led 16 senators in sending a letter to the Chair and Ranking Member of the Senate Appropriations Subcommittee on Labor, Health and Human Services, Education, and Related Agencies requesting the committee provide $2.7 billion in Fiscal Year (FY) 2024 to fund the Office of Federal Student Aid.

- In February 2023, Senator Warren released a new report based on her investigation into how efforts by Republican officials and special interests to block the President’s plan to cancel up to $20,000 in federal student loan debt would affect Americans.

- In October 2022, Senator Warren and Representative Ayanna Pressley (D-Mass.) visited communities across Massachusetts to celebrate the Biden administration’s student debt cancellation plan and help residents sign up for student loan relief.

- In October 2022, Senator Warren called on the Department of Education to hold for-profit colleges executives accountable for scamming students out of a quality education and loading them up with student debt.

- In September 2022, Senator Warren and Representative Pressley sent a letter to federal student loan servicers to inquire about the steps they are taking to ensure borrowers are receiving timely information about President Biden’s debt cancellation plan.

- In September 2022, Senator Warren sent a letter to the Department of Justice (DOJ) urging DOJ to issue and implement updated student debt bankruptcy guidance without delay following the Biden-Harris administration’s historic decision to cancel up to $20,000 in student debt for up to 43 million borrowers and overhaul the student loan system.

- In August 2022, Senator Warren recognized the Department of Education for protecting students and taxpayers by taking action to revoke ACICS status as an accreditor.

- Senator Warren, along with Senate Democratic Whip Dick Durbin (D-Ill.), Senator Brown and Representatives Pramila Jayapal (D-Wash.) and Mark Takano (D-Calif.), urged Secretary of Education Miguel Cardona to swiftly discharge the loans of borrowers defrauded by predatory for-profit colleges and universities, including those operated by Corinthian College.

- Senator Warren, along with Senate Majority Leader Charles E. Schumer (D-N.Y.) and Representatives Jayapal, Pressley, Ilhan Omar (D-Minn.), and Katie Porter (D-Calif.) led more than 80 colleagues in a bicameral letter to the Department of Education calling for it to release the memo outlining the Biden administration’s legal authority to cancel federal student loan debt and immediately cancel up to $50,000 of debt for Federal student loan borrowers.

- Senator Warren, along with Senate Majority Leader Schumer and Representative Pressley released new analysis showing that resuming student loan payments would strip $85 billion every year from the economy.

- Senator Warren, along with Senators Van Hollen, Blumenthal, and Smith sent letters to four federal loan servicers, requesting information on their plans to support borrowers when student loan payments resume.

- Senator Warren, along with Senators Brown, Blumenthal, Smith, and Van Hollen sent a letter to Maximus, the company that is assuming Navient’s federal student loans servicing contract, questioning its troubling history and seeking assurances that borrowers will receive appropriate services and protections during the transition.

- Senator Warren, along with Senators Brown, Blumenthal, Smith, Van Hollen, Booker, Sanders, Tammy Baldwin (D-Wis.), and Markey sent a letter to the Department of Education urging Secretary Cardona to use his authority to automatically remove all student loan borrowers in default.

- Senator Warren, along with Senators Van Hollen, Blumenthal, Brown, Smith, Markey, and Robert Menendez (D-N.J.) sent letters to the heads of Pennsylvania Higher Education Assistance Agency, Granite State, and Navient calling on them to correct past errors with borrowers’ accounts and address growing concerns over their preparedness to transfer millions of borrowers to new servicers.

- Senator Warren, along with Senator Markey and Representative Pressley, released a report that detailed the ongoing failures of the Public Service Loan Forgiveness program for public servants in Massachusetts.

- At a hearing in July 2021, Senator Warren pushed for borrower protections after a major student loan servicing shakeup.

- In July 2021, Senator Warren released a statement regarding the end of the Pennsylvania Higher Education Assistance Agency's (PHEAA) contract servicing student loans with the Department of Education.

- In June 24, 2021, Senators Warren and John Kennedy (R-La.) called on PHEAA CEO to address concerns about false and misleading statements made during a subcommittee hearing on student loans, which was chaired by Senator Warren.

- In May 2021, Senator Warren led her colleagues in sending a letter requesting information about the steps the Department of Education and the Office of Federal Student Aid (FSA) was taking to help transition millions of federal student loan borrowers back into repayment ahead of the scheduled end to the pause on student loan payments and interest in September 2021.

- In April 2021, Senators Warren and Raphael Warnock (D-Ga.) led a group of colleagues in a letter to Education Secretary Miguel Cardona urging the Department of Education to take swift action to automatically remove all federally-held student loan borrowers from default.

- In April 2021, at her first hearing as chair of the Senate Banking, Housing, and Urban Affairs Committee's Subcommittee on Economic Policy, Senator Warren called out PHEAA for its mismanagement of the Public Student Loan Forgiveness Program.

- In April 2021, Senator Warren also questioned Jack Remondi, CEO of Navient, on the company's long history of abusive and misleading behavior towards borrowers and their profiting off the broken student loan system.

- In March 2021, Senators Warren and Menendez applauded the passage of their Student Loan Tax Relief Act as part of the American Rescue Plan.

- In December 2020, Senator Warren introduced the Consumer Bankruptcy Reform Act and in 2019, co-led the Student Borrower Bankruptcy Relief Act with Senator Durbin to make student loans dischargeable through bankruptcy.

Source: Senator Elizabeth Warren