Warren: “Republicans are in bed with big business to rip off families and to protect corporate bottom lines (while) Director Chopra and President Biden are cracking down on junk fees so that they can help lower costs for American families.”

Last month, the CFPB launched a public inquiry into junk fees in mortgage closing costs that disproportionately hurt lower-income, first-time, and Black and Hispanic homebuyers.

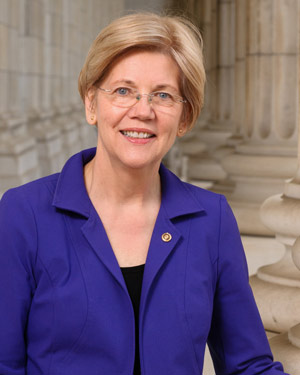

June 17, 2024 - Washington, D.C. — Last week, at a hearing of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, U.S. Senator  Elizabeth Warren (D-Mass.) questioned Director of the Consumer Financial Protection Bureau (CFPB) Rohit Chopra on the Bureau's efforts to tackle junk fees across the housing market. The hearing follows a May 2024 announcement that the Bureau had opened a public inquiry into junk fees and their impact on mortgage closing costs that push homeownership out of reach for many, and a 7-2 Supreme Court ruling in CFPB v. Community Financial Services Association of America that upheld the constitutionality of the Bureau’s funding structure, allowing it to continue its work protecting consumers from predatory practices and institutions.

Elizabeth Warren (D-Mass.) questioned Director of the Consumer Financial Protection Bureau (CFPB) Rohit Chopra on the Bureau's efforts to tackle junk fees across the housing market. The hearing follows a May 2024 announcement that the Bureau had opened a public inquiry into junk fees and their impact on mortgage closing costs that push homeownership out of reach for many, and a 7-2 Supreme Court ruling in CFPB v. Community Financial Services Association of America that upheld the constitutionality of the Bureau’s funding structure, allowing it to continue its work protecting consumers from predatory practices and institutions.

During her questioning, Senator Warren praised Director Chopra for “slashing junk fees, policing Wall Street, and… returning over $20 billion dollars to consumers.” Director Chopra confirmed that junk fees in housing are rising, and Senator Warren pointed to statistics that show a 36% jump in closing costs from 2021 to 2023.

Director Chopra also confirmed to Senator Warren that, to his knowledge, the CFPB has never received a complaint from a consumer that they are not getting charged enough in junk fees.

Transcript: The Consumer Financial Protection Bureau’s Semi-Annual Report to Congress

U.S. Senate Committee on Finance

June 12, 2024

Senator Warren: Thank you Mr. Chairman.

So, Director Chopra, the last time you were here the Supreme Court was considering a lawsuit championed by predatory lenders and their Republican allies challenging the constitutionality of the CFPB funding. Now fortunately, the Supreme Court followed the law. And the CFPB is here to stay.

Now the bureau can keep doing its work to deliver on President Biden's agenda:, slashing junk fees, policing Wall Street and so far returning $20 billion to consumers. But Republicans just can’t seem to quit you, Director Chopra. It's another day that ends in “Y” so Republicans are concocting even more absurd legal arguments and taking even more extreme steps to try to stop the CFPB from doing its work on behalf of American families.

Let’s start with junk fees. For some reason, Republicans just love them. A few months ago, a Republican congressman said, and I quote, “Junk fees don't exist, ok? That’s a figment of Rohit Chopra's imagination.”

So, Director Chopra. We have you here. I figured I’d go straight to the source. Are junk fees a figment of your imagination, you know, like Bigfoot?

Rohit Chopra, director, Consumer Financial Protection Bureau: I don't know who said that, but I think for everyone who experienced a junk fee, it’s incredibly insulting. Because they are paying up for things that are providing, sometimes, no service whatsoever. And I’m really proud of the work we have done to wipe out billions of dollars of junk fees.

Senator Warren: Do you have an estimate on how much Americans are paying in junk fees?

Director Chopra: I don’t have the latest update, but it is tens of billions of dollars. Our work, I think, is already delivering, taking out a huge chunk of that. It’s making the economy more competitive and making pricing clear upfront rather than scattered on the seventh screen.

Senator Warren: You know, it’s a lot of money that American families are losing to junk fees, but since Republicans are falling all over themselves to defend these junk fees, I wonder if Republicans are hearing something different from the American people that I’m just not hearing.

Director Chopra, the CFPB has a hotline for consumer complaints. People actually call you directly. So has anyone ever called the hotline to complain that they are not getting charged enough in junk fees on their credit cards or their bank accounts or their car loans?

Director Chopra: I have never heard of that, ever.

Senator Warren: Fair enough.

You know, my sense is Americans are not clamoring for more junk fees, but Senate Republicans are ready to do the dirty work for their corporate pals.

After the CFPB finalized its rule to limit exorbitant credit card late fees, Senate Republicans introduced a resolution to reverse the CFPB’s rule and take $10 billion away from Americans.

Now, fortunately, it doesn't seem to be stopping the CFPB from working on behalf of American families. Just last month, the bureau launched an investigation into mortgage junk fees, including the closing costs that families pay when they buy a house.

Director Chopra, can you say a little more about why the CFPB is focusing on junk fees in housing right now?

Director Chopra: Well those fees can really drain someone's down payment and really bump up a monthly payment if they are able to get the mortgage, or could foreclose them from even getting a home. This is something where the mortgage lenders are also upset about, because they’re being price gouged and having to pass on some of those costs to consumers.

Senator Warren: Right, and do you have any sense of whether those junk fees are holding level, going down, or going up?

Director Chopra: They’ve been going up. We’ve been seeing — at least I can say about closing costs — a market increase in closing costs in the past several years.

Senator Warren: So, I saw one source citing that from 2021 to 2023, that closing costs rose by 36%. Do you have any explanation for that other than junk fees?

Director Chopra: Well, there’s certainly — some aspects, it’s possible there are more individuals doing points, rate buydowns. But, certainly, there are other places where fees have been inflated that mortgage lenders and consumers are both pretty mad about.

Senator Warren: So, I understand that in 2022, a typical borrower paid nearly $6,000 in extra fees to close on a home. And that right now the CFPB is working on trying to put at least a chunk of that money back in the buyer’s pocket, is that right?

Director Chopra: That's right. I think that will help the entire economy.

Senator Warren: All right.

So, if you're wondering why Republicans are introducing legislation to protect junk fees and working overtime to come up with fantastical legal theories to kill the CFPB, I think the answer is pretty clear. Republicans are in bed with big business to rip off families and to protect corporate bottom lines. Director Chopra and President Biden are cracking down on junk fees so that they can help lower costs for American families. And I thank you for your work.

Thank you, Mr. Chairman.

Source: Senator Elizabeth Warren