Rising worries about jobs and income offset more optimistic views of current and future business conditions

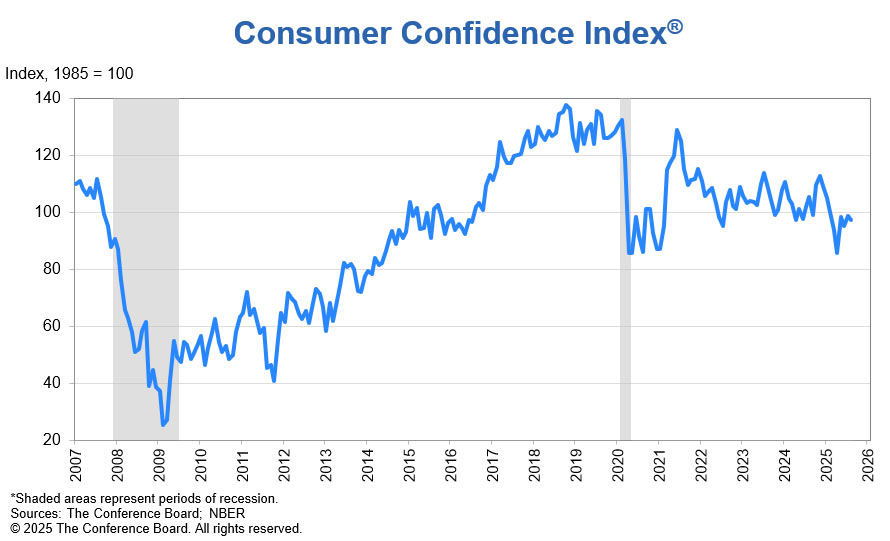

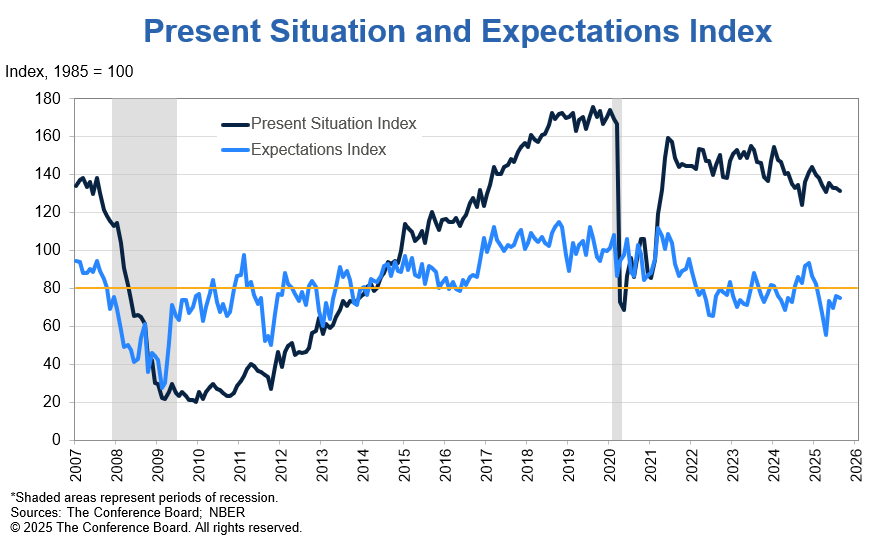

August 27, 2025 - The Conference Board Consumer Confidence Index® fell by 1.3 points in August to 97.4 (1985=100), down from 98.7 in July (revised up by 1.5 points). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell by 1.6 points to 131.2. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased by 1.2 points to 74.8. Expectations remained below the threshold of 80 that typically signals a recession ahead. The cutoff date for preliminary results was August 20, 2025.

“Consumer confidence dipped slightly in August but remained at a level similar to those of the past three months,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The present situation and the expectation components both weakened. Notably, consumers’ appraisal of current job availability declined for the eighth consecutive month, but stronger views of current business conditions mitigated the retreat in the Present Situation Index. Meanwhile, pessimism about future job availability inched up and optimism about future income faded slightly. However, these were partly offset by stronger expectations for future business conditions.”

Among demographic groups, confidence fell for consumers under 35 years old, was stable for consumers aged 35 to 55, and rose for consumers over 55. The evolution of confidence by income groups was mixed, with no clear pattern emerging. By partisan affiliation, confidence weakened in August among both Republicans and Democrats but was little changed for Independents.

Guichard added: “Consumers’ write-in responses showed that references to tariffs increased somewhatand continued to be associated with concerns about higher prices. Meanwhile, references to high prices and inflation, including food and groceries, rose again in August. Consumers’ average 12-month inflation expectations picked up after three consecutive months of easing and reached 6.2% in August—up from 5.7% in July but still below the April peak of 7.0%.”

Among the write-in responses, there was also a rise in mentions of jobs and employment, even though these remained relatively low on the list of themes consumers are focused on. Most negative comments on the labor market referred to the current situation while positive comments conveyed hopes that things would get better.

In August, consumers’ outlook on stock prices deteriorated slightly, with 47.4% of consumers expecting stock prices to increase over the next 12 months, down from 48.9% in July. Conversely, 30.3% of consumers expected stock prices to decrease over the next 12 months, up from 28.1% in July. The share of consumers expecting interest rates to riseincreased to 54.0% from 53.1% in July and fewer consumers expected interest rates to fall (20.9% vs 21.4% in July).

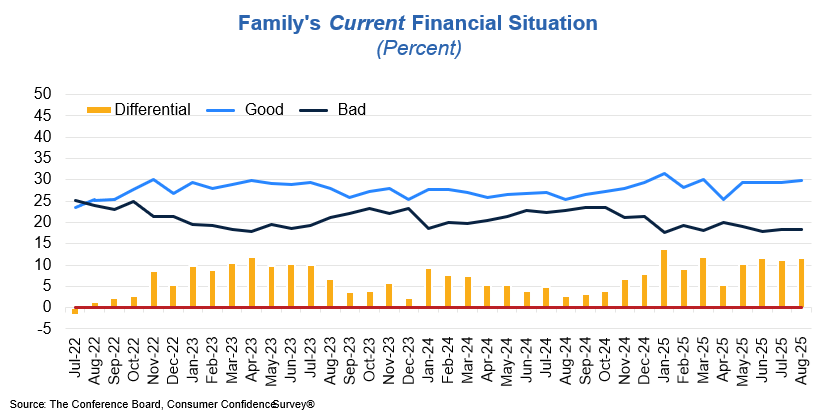

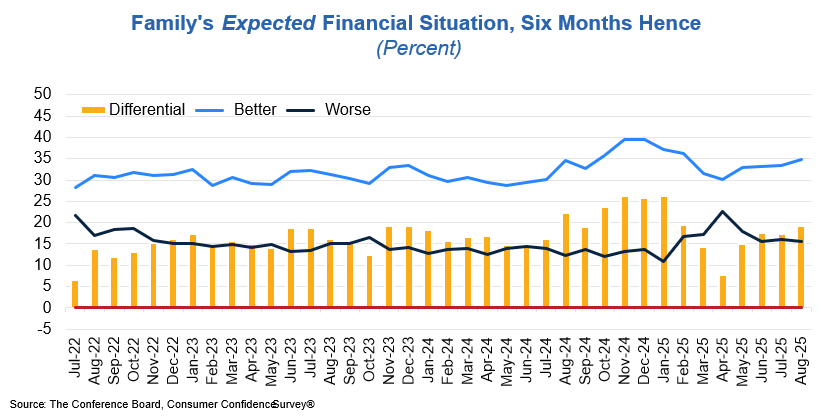

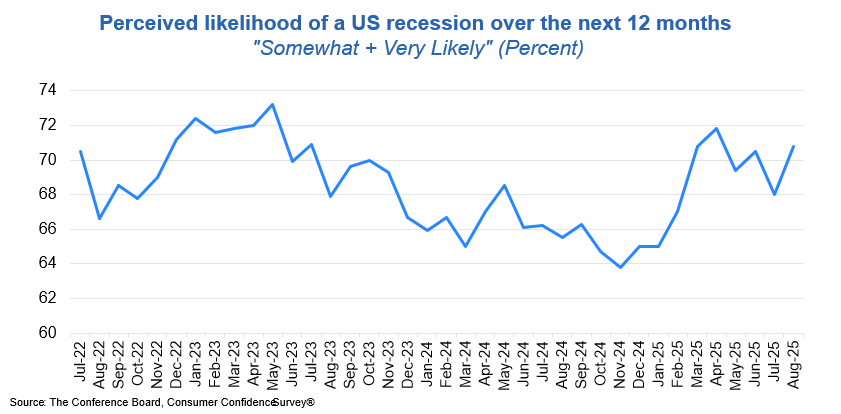

Consumers’ views of their Family’s Current and Future Financial Situation both improved in August. The share of consumers expecting a recession over the next 12 months rose in August to the highest level since the April peak. (These measures are not included in calculating the Consumer Confidence Index®).

Purchasing plans for cars increased in August, with buying intentions for both used and new cars rising.Meanwhile, purchasing plans for homes remained stable after July’s decline.Consumers’ plans to buy big-ticket items were slightly down overall, but with a lot of variation from one item to the next: the strongest increases in buying intentions were for washers and dryers, with the largest declines in TVs and tablets. Consumers’ intentions to purchase more services ahead improved, but the increases were concentrated in a few, mostly non-discretionary categories such as financial services and car and home maintenance. Discretionary spending plans—including on dining out and outdoor and indoor entertainment—were down. Vacation intentions fell for a second straight month, with intentions to travel abroad and within the US both declining.

Present Situation

Consumers’ assessments of current business conditions improved slightly in August.

- 22.0% of consumers said business conditions were “good,” up from 20.5% in July.

- 14.2% said business conditions were “bad,” also up from 13.6%.

Consumers’ views of the labor market cooled further in August.

- 29.7% of consumers said jobs were “plentiful,” down slightly from 29.9% in July.

- 20.0% of consumers said jobs were “hard to get,” up from 18.9%.

Expectations Six Months Hence

Consumers were less pessimistic about future business conditions in August.

- 19.5% of consumers expected business conditions to improve, up from 19.0% in July.

- 21.9% expected business conditions to worsen, down from 22.7%.

Consumers were a bit more worried about the labor market outlook in August.

- 17.9% of consumers expected more jobs to be available, down from 18.0% in July.

- 26.8% anticipated fewer jobs, up from 25.1%.

Consumers’ outlook for their income prospects was less positive in August.

- 18.3% of consumers expected their incomes to increase, down from 18.7% in July.

- 12.6% expected their income to decrease, up from 11.8%.

Assessment ofFamily Finances and Recession Risk

- Consumer assessments of their Family’s Current Financial Situation were slightly more positive in August.

- Consumer assessments of their Family’s Expected Financial Situation strengthened slightly.

- Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months rose in August.

The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was August 20.

Source: August 2025 Consumer Confidence Survey®

The Conference Board

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org.

Source: The Conference Board