The Senator’s recent investigation reveals need for new, strong regulations to protect retail investors from SPAC industry ripoffs

Text of Letter (PDF) | Responses from SPACs (PDF)

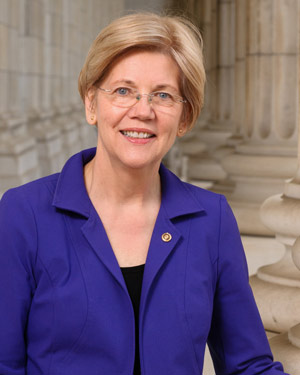

July 11, 2022 - Washington, D.C. – U.S. Senator Elizabeth Warren (D-Mass.) sent a letter to U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, supporting  the agency’s proposed rules for special purpose acquisition companies (SPACs). The rules would enhance disclosures and investor protections in SPAC initial public offerings and de-SPAC transactions.

the agency’s proposed rules for special purpose acquisition companies (SPACs). The rules would enhance disclosures and investor protections in SPAC initial public offerings and de-SPAC transactions.

SPACs are publicly traded shell companies that raise money for the sole purpose of buying a private company to take it public. These shell companies are structured to benefit institutional investors – such as hedge funds, venture capitalists, and investment banks – at the expense of retail investors.

In 2021, Senator Warren launched an investigation into SPACs, writing to six high-profile SPAC creators, and asking the SEC to investigate Digital World Acquisition Corp., the SPAC that proposed merging with former President Trump’s Truth Social. Senator Warren released a report in June highlighting the findings of her investigation, which revealed misaligned incentives, self-dealing, and fraud that plague the industry.

“Our investigation found rampant fraud and self-dealing in the SPAC sector, and requiring additional disclosures on SPAC sponsors, boards of directors, and financial institution’s potential conflicts of interest could give retail investors more transparency into the decision-making process,” said the letter.

Sen. Warren’s investigation, which she highlighted in her letter, also revealed several major findings on SPACs’ structural and regulatory weaknesses:

- SPAC sponsors’ incentives and outcomes do not align with retail investors, leading to low-quality deals that harm investors. The sponsor’s “promote,” a 20% share in the public company that sponsors pay a fraction of market value for, almost always guarantees a profit for sponsors, who frequently pay tens of thousands of dollars for nearly hundreds of million in stock. Since SPACs face time pressure to complete a merger, SPAC sponsors are incentivized to push low-quality deals to ensure they receive their promote.

- SPAC shortcuts give institutional investors and Wall Street insiders profitmaking opportunities that dilute shares for retail investors and put underlying companies at risk. Institutional investors are given early access to information and discounted stock before retail investors can participate on the open market, and frequently invited to participate in PIPEs, or private investment in public equity, that widen the information and access gap. These “shortcuts,” which practically guarantee profits for Wall Street insiders, dilute retail investors’ stock and reduce the capital available to companies after they are taken public.

- Financial institutions profit off SPACs through hidden fees that outstrip those of a traditional IPO. Although SPAC sponsors touted lower fees as a benefit of SPAC transactions, financial institutions charge a host of fees – including an underwriter fee, a PIPE placement agent fee, and a financial advisor fee – which outstrip a traditional IPO and guarantee millions in profits for the institutions even when the businesses they take public fail.

- SPACs incentivize inadequate and even fraudulent disclosures. Regulatory loopholes, lax requirements, and the misaligned incentives of the decision-makers have created an environment where SPACs are rife with disclosures that border on or cross into outright fraud.

- SPACs allow for rampant self-dealing at the expense of retail investors and the health of the market. SPAC sponsors take advantage of the flaws in SPAC rules to benefit themselves in multiple steps of the process: paying advisory fees to themselves and companies they are associated with, participating in PIPEs, and private investment rounds despite their clear insider knowledge, and even choosing their own companies as acquisition targets.

- Further regulation and federal legislation is needed to protect retail investors and the market from the impact of SPACs. In March 2022, the SEC proposed several new rules for SPACs that would increase disclosures required for companies going public through SPACs, and increase liability for SPAC sponsors and acquisition companies. While an important step, Congress should act to codify these rules into law and encourage the implementation of these rules.

Senator Warren has been a leader in calling for additional regulation of SPACs. She is planning to introduce the SPAC Accountability Act of 2022 which would codify and expand upon the SEC’s proposed rules. This legislation would expand the transparency and disclosure requirements to further protect retail investors and prevent Wall Street insiders from prematurely cashing out on SPAC deals.

Source: Senator Elizabeth Warren